#516654

Postby SKYSHIP » July 23rd, 2022, 4:06 pm

Rising interest rates used to be a problem for propcos; this time around however all of them have locked in medium to long-term date at ultra-low interest rates - SREI for instance have 13yr debt at a mere 2.3%!

Outright recession would of course be a concern to rental values and voids, but IMO current valuations after the recent falls already totally discount such fears.

CTPT are again anomalously cheap for a rather bizarre reason. The 20% fall since peaking at 96p in May seems to have just one reason. A fellow propco - VIP - bought a 6% stake at c91p, buying aggressively in the market. Then, in July they did a sudden, inexplicable volte face, turning seller. Selling into a falling market of their own making; and selling down to 77p where the NAV discount is 40%.

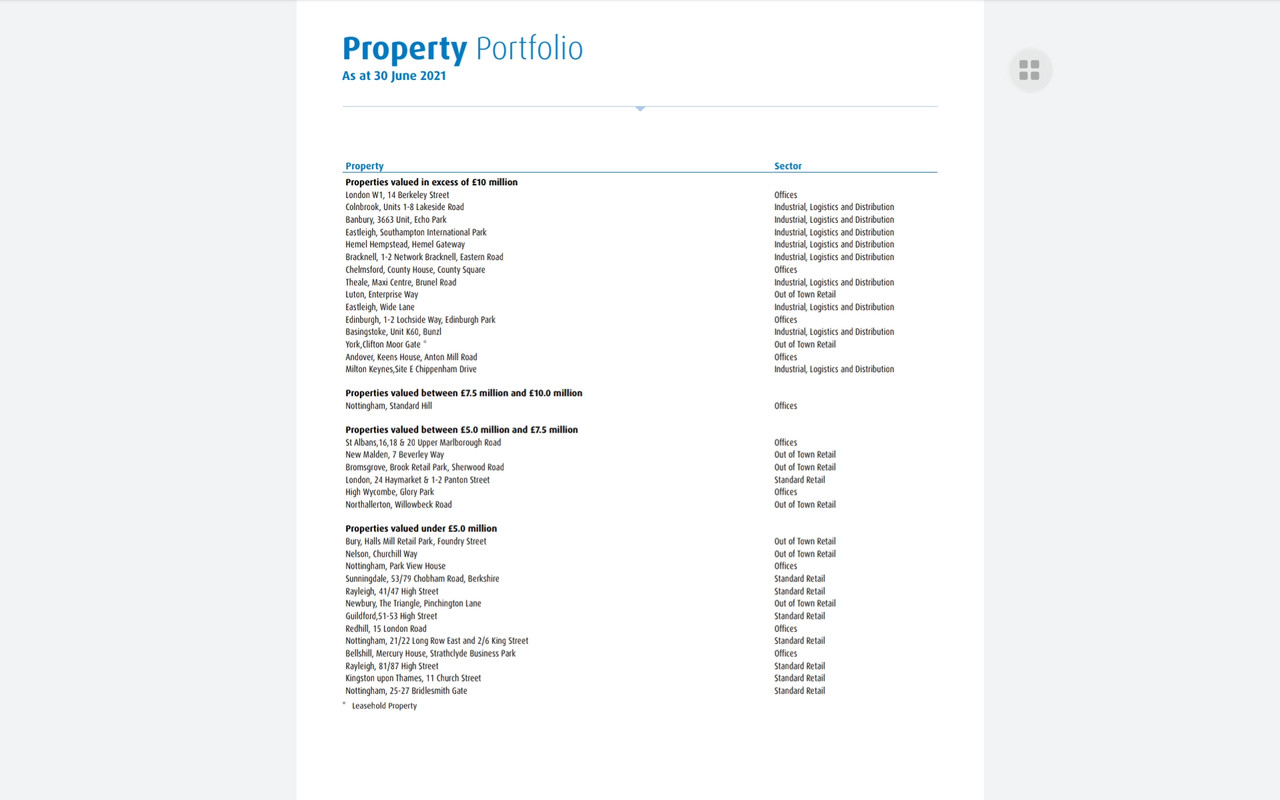

This sell-off is an opportunity for buyers for two reasons. Firstly, CBRE stats suggest the imminent RNS for the Q2 NAV figure will likely provide CTPT with another 3% NAV uplift to c132p, taking the discount to 39.4% on Friday's slightly higher 80p sp. Secondly and more importantly, last week saw the arrival of a new Investment Manager, moving across from BCPT. He will therefore be more attuned to the possibility of buybacks, which in CTPT's case might well be fully funded by the likely imminent sale of their prime asset Mayfair property on the market for "Offers in excess of £30.75m".

In the first instance expect a near-term recovery into the mid 80s; though more patience may be required if VIP continue to do the indefensible.