Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Is there an optimal time to repair your portfolio allocation?

-

dingdong

- Lemon Pip

- Posts: 65

- Joined: September 29th, 2018, 1:37 pm

- Has thanked: 2 times

- Been thanked: 39 times

Is there an optimal time to repair your portfolio allocation?

I have a historic workplace pension with the investment allocation being

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

Re: Is there an optimal time to repair your portfolio allocation?

dingdong wrote:I have a historic workplace pension with the investment allocation being

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

You could just freeze/discontinue the allocation going into the UK Tracker, but leave the funds there, and direct future ongoing allocations into the World Tracker. Then monitor price movements. If later you feel the price of the UK holding improves significantly, you could then make a decision about whether to move any of that into the World Tracker.

-

tjh290633

- Lemon Half

- Posts: 8312

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 920 times

- Been thanked: 4150 times

Re: Is there an optimal time to repair your portfolio allocation?

dingdong wrote:I have a historic workplace pension with the investment allocation being

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

If it were me I wouldn't have gone this way but, as you have, you might like to set limits on the maximum weight of a holding. Let's say 60%. If one goes over 60%, then sell 20% and reinvest in the other, effectively rebalancing.

Better if you were more diversified, because with individual shares, this year's winners are often next year losers and vice versa. With trackers it depends what you are tracking, of course.

TJH

-

Newroad

- Lemon Quarter

- Posts: 1100

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 344 times

Re: Is there an optimal time to repair your portfolio allocation?

Hi DingDong.

Here's one view. The theory that I (mostly) follow suggests a "No Trade Zone" of half of the average portfolio weight of an asset. So, in a two stock portfolio, this would be half of 50% (so 25%). Using this theory, you wouldn't do anything if both assets remained in a 37.5% - 62.5% band.

The question then becomes how much you rebalance if outside this band?

For large portfolios, this theory suggests a Minimum Trade (Rebalance) Size of 0.1% of portfolio, for smaller portfolios, it suggests a function of costs. That's perhaps not helpful in this example.

I personally think there is a case for running your winners, so trimming rather than (fully) rebalancing, i.e. retaining upside whilst not being completely exposed. So, rounding 62.5% to Terry's proposed 60% (an easier calculation), I might take the view

However, this is just my opinion.

Regards, Newroad

Here's one view. The theory that I (mostly) follow suggests a "No Trade Zone" of half of the average portfolio weight of an asset. So, in a two stock portfolio, this would be half of 50% (so 25%). Using this theory, you wouldn't do anything if both assets remained in a 37.5% - 62.5% band.

The question then becomes how much you rebalance if outside this band?

For large portfolios, this theory suggests a Minimum Trade (Rebalance) Size of 0.1% of portfolio, for smaller portfolios, it suggests a function of costs. That's perhaps not helpful in this example.

I personally think there is a case for running your winners, so trimming rather than (fully) rebalancing, i.e. retaining upside whilst not being completely exposed. So, rounding 62.5% to Terry's proposed 60% (an easier calculation), I might take the view

- If the balance goes to 60-40, then

Rebalance to 55-45, then

Rinse and repeat

However, this is just my opinion.

Regards, Newroad

-

tjh290633

- Lemon Half

- Posts: 8312

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 920 times

- Been thanked: 4150 times

Re: Is there an optimal time to repair your portfolio allocation?

Newroad wrote:Hi DingDong.

Here's one view. The theory that I (mostly) follow suggests a "No Trade Zone" of half of the average portfolio weight of an asset. So, in a two stock portfolio, this would be half of 50% (so 25%). Using this theory, you wouldn't do anything if both assets remained in a 37.5% - 62.5% band.

The question then becomes how much you rebalance if outside this band?

For large portfolios, this theory suggests a Minimum Trade (Rebalance) Size of 0.1% of portfolio, for smaller portfolios, it suggests a function of costs. That's perhaps not helpful in this example.

I personally think there is a case for running your winners, so trimming rather than (fully) rebalancing, i.e. retaining upside whilst not being completely exposed. So, rounding 62.5% to Terry's proposed 60% (an easier calculation), I might take the viewIf the balance goes to 60-40, then

Rebalance to 55-45, then

Rinse and repeat

However, this is just my opinion.

Regards, Newroad

Yes, the numbers are just illustrative. You could have 75%/25% if you wanted.

TJH

-

GoSeigen

- Lemon Quarter

- Posts: 4442

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1615 times

- Been thanked: 1607 times

Re: Is there an optimal time to repair your portfolio allocation?

This is one of the problems with passive investments. Everyone says "just buy a world tracker" but what if the world tracker is dominated by one country's shares and what if that country's market is dominated by fewer than a dozen huge potentially egregiously overpriced stocks? Well, you like in the UK and everyone says "just buy a uk tracker and get more home country exposure" so you do and it goes on a few years and you are doing really well because your fees are low, but you're not doing as well as you should if you'd bought a world tracker because now you've got all this UK stuff which has underperformed and you are underweight USA. But fixing it is a problem because you have to buy a tracker again because passive is the Only Way and now you feel the US ia even more overvalued than the UK. So maybe you do something clever like buy a developing world tracker because that looks promising and it at least dilutes the UK and so it goes on and soon you find you're actually stock picking, but you're just doing it with tracker ETFs.

I should add that selling the UK tracker at all time highs is lucky, but what if the all-time highs keep coming and coming and coming. Then as a passive investor you have managed to sell low. Not too smart.

I don't think you personally are doing anything particularly wrong, I just think "everyone should buy a tracker" is flawed in its conception.

GS

I should add that selling the UK tracker at all time highs is lucky, but what if the all-time highs keep coming and coming and coming. Then as a passive investor you have managed to sell low. Not too smart.

I don't think you personally are doing anything particularly wrong, I just think "everyone should buy a tracker" is flawed in its conception.

GS

-

Bubblesofearth

- Lemon Quarter

- Posts: 1116

- Joined: November 8th, 2016, 7:32 am

- Has thanked: 12 times

- Been thanked: 453 times

Re: Is there an optimal time to repair your portfolio allocation?

GoSeigen wrote:I don't think you personally are doing anything particularly wrong, I just think "everyone should buy a tracker" is flawed in its conception.

GS

But not in its historic performance;

https://curvo.eu/backtest/en/market-ind ... rrency=eur

But, hey, maybe things will be different in the future....

BoE

-

EthicsGradient

- Lemon Slice

- Posts: 586

- Joined: March 1st, 2019, 11:33 am

- Has thanked: 34 times

- Been thanked: 235 times

Re: Is there an optimal time to repair your portfolio allocation?

dingdong wrote:I have a historic workplace pension with the investment allocation being

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

I've been rebalancing, due to my historical decisions (that turned out to be wrong) that the American market had been overvalued and buying other regions instead. Now I've decided to rebalance to more or less a global tracker weighting (some are outside my ISA and SIPP, which complicates things from a CGT point of view). But I had the choice of which to do, so I've been selling my overweight European funds now, a bit each month, which have done OK recently, and when that's done, I'll sell some emerging markets, in the hope they've picked up a bit by then. If they haven't, I'll probably take the hit and sell them anyway.

If the actions to swap between the funds in your workplace pension aren't too onerous, then in your position I might split the rebalancing into bits, and separate them a bit, to smooth the risk of bad timing - eg if you want to end up 20% UK, 80% Global, then move 10%, wait a few months, move 10% more, then the final 10% a few months after that.

-

kempiejon

- Lemon Quarter

- Posts: 3593

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1198 times

Re: Is there an optimal time to repair your portfolio allocation?

dingdong wrote:How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

My SIPP is made of Vanguard ETFs to give what I see as global coverage with gold and bonds too. I use regional specific ETFs for Japan, emerging markets, Europe, USA, Asia etc. I ignore UK in the SIPP, I have FTSE shares in the ISA. I don't see changes in weightings from the original as needing fixing, I expect a bit of ebb and flow. I don't try and time, I've avoided drastic action, when I've had larger amounts I tended to spread it over a few quarters as that suits my psyche.

When I used to look at balance, about quarterly, was when I first started my SIPP. I was able to find the money, I was making my investment plans. For the first 2 or 3 years of the life of my SIPP I had lumps as I collected old pensions together. I also had monthly income to direct and unused allowances from previous years. I now rarely fund. The portfolio is done, no new money. Once a year I take a deeper look, don't usually take action. I know my USA is comparatively ahead of other regions as there's been faster growth there. I have a few bits of shuffling to do now there's a new allowance for income tax, SIPP and ISA, inevitably removing money and buying new components will change the weightings a bit. Compared to a global tracker for example I'm underweight USA it being about 60% of for example VWRL.

dingdong wrote: However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

Might be a good move.

-

1nvest

- Lemon Quarter

- Posts: 4475

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 712 times

- Been thanked: 1391 times

Re: Is there an optimal time to repair your portfolio allocation?

dingdong wrote:I have a historic workplace pension with the investment allocation being

50% UK Tracker

50% World Tracker

Both with insanely low fees.

Clearly the UK tracker has performed terribly compared to the world tracker and is massively overweight. However i'm conscious that US stocks are currently high though and fixing the allocation at this point when the UK is possibly considered better value might end up being a bad move.

How do others handle this? Given the challenge of timing anything is it better just taking the hit and fixing your portfolio the moment you notice an issue? Or do people wait to try to find the right moment for drastic action based on market conditions? Or is it a once a year thing on a fixed date?

End of the fiscal year/start of the new is the better time to make changes as you have the added option to buy/sell in old/new tax year according to whichever is the more tax efficient.

Rebalancing, or not, broadly have the same reward outcome. With non-rebalanced you just end up with a high average weighting in the assets that performed the best, lower weighting in the assets that performed relatively poorly. The main difference is in risk-reduction where rebalancing reduces over-concentration risk and as such rebalancing generally has the better risk-adjusted reward (Sharpe Ratio).

The US is doing well predominately due to a few exceptional/great stocks, concentrated risk. At other times that can backfire, fell relatively more in the dot com crisis period for instance. The entire FT100 market cap is little larger than a single US stocks market cap at present.

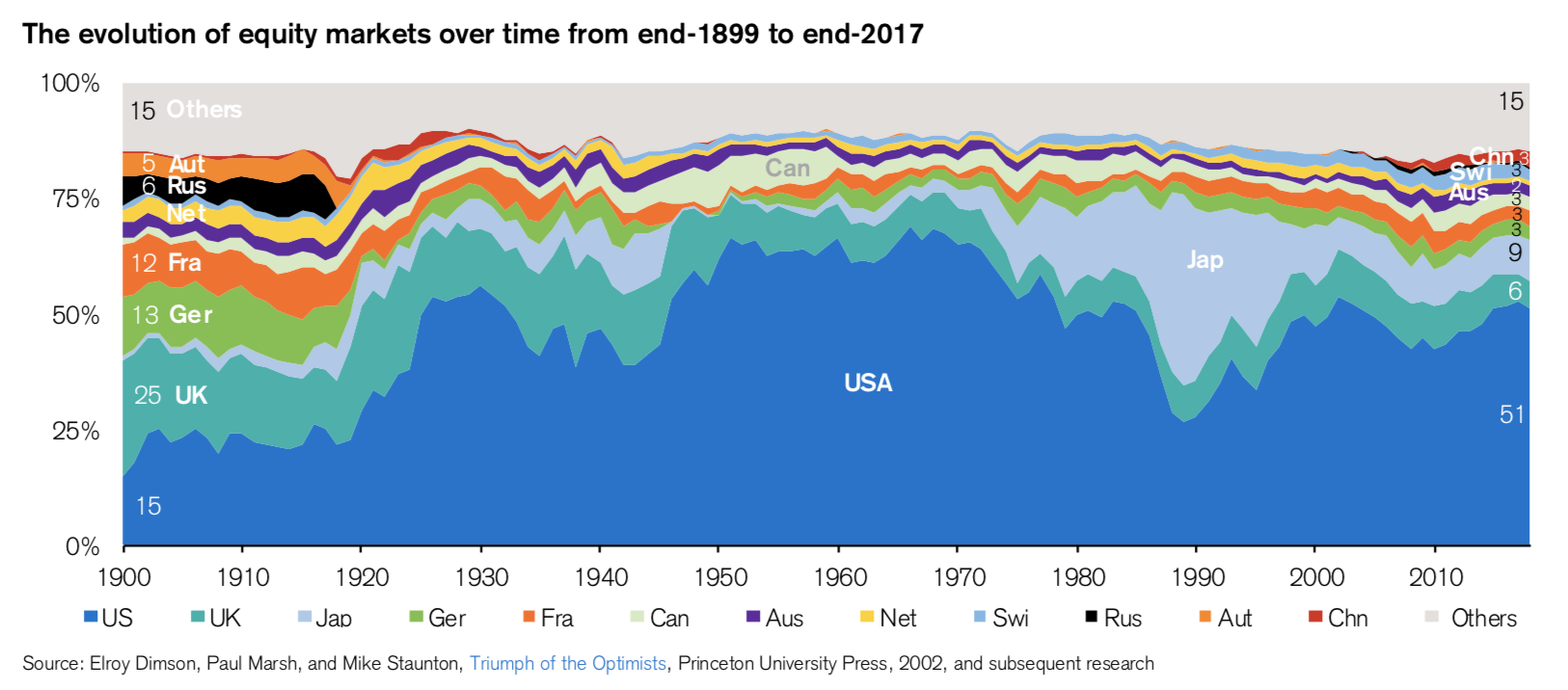

World will see country weightings drift over time, Japan rose from relatively low weight in the 1970's to eat much of US's weighting in the 1990's

A factor with cap weightings is that you're buying into recent relative strength. There are indications of it being better to initially equal weight and then leave that as-is to find its own cap weightings. Similar sort of debate around whether HYP left as-is or rebalanced/tweaked is better or not. For risk reduction purposes again rebalancing periodically back towards equal weightings is perhaps the better risk-adjusted reward choice.

Given you've missed this years April fiscal year end/start ideal rebalance timepoint, another choice might be to assess the ongoing situation. The US is doing well in part due to the flight to safety of US dollars in global times of stress/fear. If that fear subsides then there may very well be a flight out of dollars to where 'better value' is seen elsewhere. With Ukraine/Israel ...etc. that fear is still relatively high.

-

JohnW

- Lemon Slice

- Posts: 532

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: Is there an optimal time to repair your portfolio allocation?

I haven't weighed in to this question as it's too hard if you allow 'optimal' to have different meanings. I don't think you can answer it if it's about confidently maximising return, tax issues aside, because predicting the future is tricky even if you examine entrails for market condition signals. That would leave me with doing it when you decide it's not the asset allocation you should have; for me that choice would be 'I want global cap weighting' or 'I want some home bias to that', or 'leave me out of emerging markets, it's not worth the extra cost' etc.

As to rebalancing as an ongoing proposition, you can backtest it at portfoliovisualizer with monthly, yearly or no rebalancing. When i do it for US with nonUS stocks, with and without emerging market stocks, the outcome differences in return, volatility and Sharpe ratios are so small and so much in different directions that why bother.

As to rebalancing as an ongoing proposition, you can backtest it at portfoliovisualizer with monthly, yearly or no rebalancing. When i do it for US with nonUS stocks, with and without emerging market stocks, the outcome differences in return, volatility and Sharpe ratios are so small and so much in different directions that why bother.

-

NotSure

- Lemon Slice

- Posts: 924

- Joined: February 5th, 2021, 4:45 pm

- Has thanked: 686 times

- Been thanked: 316 times

Re: Is there an optimal time to repair your portfolio allocation?

GoSeigen wrote:Everyone says "just buy a world tracker" but what if the world tracker is dominated by one country's shares and what if that country's market is dominated by fewer than a dozen huge potentially egregiously overpriced stocks?

Taking good old Vanguard Global as an example, it has 4.2% in Microsoft, 3.4% in Apple, 2.9% in NVIDIA and 2.2% in Amazon. Meta and Alphabet are 1.x%, everything else is less than 1%.

Is this really horrendous concentration risk? A 20 share portfolio has ~5% in each! How many shares (and how much buying/selling fees) would you recommend for active management to avoid this apparent concentration risk?

p.s. I m not stalking you...

-

GoSeigen

- Lemon Quarter

- Posts: 4442

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1615 times

- Been thanked: 1607 times

Re: Is there an optimal time to repair your portfolio allocation?

NotSure wrote:GoSeigen wrote:Everyone says "just buy a world tracker" but what if the world tracker is dominated by one country's shares and what if that country's market is dominated by fewer than a dozen huge potentially egregiously overpriced stocks?

Taking good old Vanguard Global as an example, it has 4.2% in Microsoft, 3.4% in Apple, 2.9% in NVIDIA and 2.2% in Amazon. Meta and Alphabet are 1.x%, everything else is less than 1%.

Is this really horrendous concentration risk? A 20 share portfolio has ~5% in each! How many shares (and how much buying/selling fees) would you recommend for active management to avoid this apparent concentration risk?

p.s. I m not stalking you...

If you want a fairly priced basket of shares it matters.

As I stated elsewhere, my daughter's CTF/ISA which I manage is 66% UK and EU bank securities. That is concentration risk -- but it's what I want because I judge there to be value in them. This is the performance since purchase of her largest 5 bank positions:

+313% +101% +90% -10% +140%

I don't think she'll be too upset with that concentration. [-10% is because the position was Bed-and ISA'd last year, don't know the actual performance but probably a bit better than that!]

GS

P.S. LOL re. stalking, my fault because I posted on the other thread by mistake and have continued there as well as here.

Who is online

Users browsing this forum: No registered users and 4 guests