Got a credit card? use our Credit Card & Finance Calculators

Thanks to jfgw,Rhyd6,eyeball08,Wondergirly,bofh, for Donating to support the site

How do I value a share?

-

Mike4

- Lemon Half

- Posts: 7203

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1666 times

- Been thanked: 3840 times

How do I value a share?

A really basic question I've been casting around for an answer to for a while now.

Imagine I notice a company who seem to have a good product or service with good prospects for the future. How do I go about working out what would be a reasonable price to pay for their shares or whether to treat with the proverbial barge pole?

I appreciate this must be a 'How long is a piece of string' question, along with 'What sort of string is it anyway?' I'd imagine one starts with the balance sheet to look at the assets compared to the share price, along the dividend in relationship to the share price as a technical basis, and then on top of that layer expectations of future growth. I don't suppose a steady business like Tesco has as much growth potential as say a biotech with a new vaccine for, oh I dunno....

Anyway I feel like there should be some basic principles to follow and I've probably overlooked several. Where can I find these please, assuming they exist?

Imagine I notice a company who seem to have a good product or service with good prospects for the future. How do I go about working out what would be a reasonable price to pay for their shares or whether to treat with the proverbial barge pole?

I appreciate this must be a 'How long is a piece of string' question, along with 'What sort of string is it anyway?' I'd imagine one starts with the balance sheet to look at the assets compared to the share price, along the dividend in relationship to the share price as a technical basis, and then on top of that layer expectations of future growth. I don't suppose a steady business like Tesco has as much growth potential as say a biotech with a new vaccine for, oh I dunno....

Anyway I feel like there should be some basic principles to follow and I've probably overlooked several. Where can I find these please, assuming they exist?

-

dealtn

- Lemon Half

- Posts: 6099

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: How do I value a share?

Mike4 wrote:A really basic question I've been casting around for an answer to for a while now.

Imagine I notice a company who seem to have a good product or service with good prospects for the future. How do I go about working out what would be a reasonable price to pay for their shares or whether to treat with the proverbial barge pole?

I appreciate this must be a 'How long is a piece of string' question, along with 'What sort of string is it anyway?' I'd imagine one starts with the balance sheet to look at the assets compared to the share price, along the dividend in relationship to the share price as a technical basis, and then on top of that layer expectations of future growth. I don't suppose a steady business like Tesco has as much growth potential as say a biotech with a new vaccine for, oh I dunno....

Anyway I feel like there should be some basic principles to follow and I've probably overlooked several. Where can I find these please, assuming they exist?

How capable, or interested, are you in Corporate Finance Theory (genuine question)? There is plenty of literature here. Few venture along that path, but the fact you have asked the question suggests the first step.

Most will simply look at its current price, accept the market is broadly efficient, rely on broker forecasts if they can be bothered (and then post purchase rely on price anchoring around that level).

Which end of the spectrum do you see yourself at?

-

AsleepInYorkshire

- Lemon Half

- Posts: 7383

- Joined: February 7th, 2017, 9:36 pm

- Has thanked: 10514 times

- Been thanked: 4659 times

Re: How do I value a share?

Augmenting dealtn's post I'd liken your question to do you want to start an apprenticeship as a plumber or do you just want to have a broad understanding of plumbing.

I have a good understanding of share value, but it's nothing like that which dealtn has. In other words he's a qualified plumber and I am not I could perhaps get away with oiling the extraction fan on a boiler, but I couldn't install one.

I could perhaps get away with oiling the extraction fan on a boiler, but I couldn't install one.

Just as an aside if I may please. I've recently spoken to several IFA's. I didn't find it useful.

AiY(D)

I have a good understanding of share value, but it's nothing like that which dealtn has. In other words he's a qualified plumber and I am not

Just as an aside if I may please. I've recently spoken to several IFA's. I didn't find it useful.

AiY(D)

-

gryffron

- Lemon Quarter

- Posts: 3640

- Joined: November 4th, 2016, 10:00 am

- Has thanked: 557 times

- Been thanked: 1616 times

Re: How do I value a share?

AsleepInYorkshire wrote:Just as an aside if I may please. I've recently spoken to several IFA's. I didn't find it useful.

IFAs are salesmen, not teachers.

Gryff

-

Mike4

- Lemon Half

- Posts: 7203

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1666 times

- Been thanked: 3840 times

Re: How do I value a share?

Thanks both of you.

My degree of interest in corporate finance theory is probably deeper than yer average retail investor, but not so deep that I want to take a degree in it. I guess my level would be as AiY guesses, and I want to understand the principles but not roll my sleeves up and actually do it on a daily basis.

For example I taught myself double entry book keeping but I switched to using a PC as soon as they came along. And I learned properly about house conveyancing from books to the point I could probably do my own (if no mortgage involved) but I still use a solicitor.

Similarly with corporate finance. I probable actually need to choose a book about it rather than anything on line. I'll read it, try to understand it then probably carry on picking shares by gut feeling!

My degree of interest in corporate finance theory is probably deeper than yer average retail investor, but not so deep that I want to take a degree in it. I guess my level would be as AiY guesses, and I want to understand the principles but not roll my sleeves up and actually do it on a daily basis.

For example I taught myself double entry book keeping but I switched to using a PC as soon as they came along. And I learned properly about house conveyancing from books to the point I could probably do my own (if no mortgage involved) but I still use a solicitor.

Similarly with corporate finance. I probable actually need to choose a book about it rather than anything on line. I'll read it, try to understand it then probably carry on picking shares by gut feeling!

-

dealtn

- Lemon Half

- Posts: 6099

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: How do I value a share?

Mike4 wrote:A really basic question I've been casting around for an answer to for a while now.

I will counter with another very basic question, which sits at the root of the answer to your (and many other) questions.

If you were offered the choice between £100 today and £100 in a year's time which would you prefer? More importantly, why?

What about £100 today and £101 in a year? £100 against £110, £150 ...?

Most will be able to see that (except in very unusual circumstances) £100 today is "better" than £100 in the future, but as the future amount increases, that preference shifts. This is the concept of future value of money, and it's inverse, discounting future cashflows back to today's value.

The next step is to consider the difference between (absolute) certain future cashflows, and uncertain ones, and how that should be adjusted for in that calculation.

Once that is grasped it is (simply!) a case of discounting those unknown, indeed unknowable, "risky" future cashflows into today's appropriate valuation.

For a share in a company there are 2 broad ways of doing this, but essentially the same thing. Either value the company (via its cashflows), or value the equity share via its cashflows. (It is very important to note there is a very big difference between valuing the company, and valuing the equity in the company - 2 very different things as companies, especially those big enough to be listed, often have more than a single source of capital).

Hopefully that is a starting point.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3444 times

Re: How do I value a share?

Have a look at Chapter 3 (~25 pages) in Phil Oakley's Book "How to Pick Quality Shares" (about £16 from Amazon).

Then there's Terry Smith's "Investing for Growth" (but maybe read the reviews)

However, from my point of view, I'm not clever enough/patient enough/have sufficient knowledge/time/contacts/resources so maybe I should just pay for the likes of Smith to do this for me?

Then there's Terry Smith's "Investing for Growth" (but maybe read the reviews)

However, from my point of view, I'm not clever enough/patient enough/have sufficient knowledge/time/contacts/resources so maybe I should just pay for the likes of Smith to do this for me?

-

scrumpyjack

- Lemon Quarter

- Posts: 4860

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2706 times

Re: How do I value a share?

The trouble is that the key issue in valuing a share is your forecast of the company's future (for many years!). Obviously the past is of interest and the state of their balance sheet may indicate if they can last til the future arrives. The market generally is looking at the future, not the past.

So get a really good crystal ball

So get a really good crystal ball

-

SalvorHardin

- Lemon Quarter

- Posts: 2065

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5386 times

- Been thanked: 2492 times

Re: How do I value a share?

I start with the assumption that the current price is a reasonable indicator, but no more than that. Markets are reasonably efficient, but they aren't the hyper rational and highly accurate instantaneous processors of information that the efficient market gurus keep telling us.

A quick look at the balance sheet, historical sales, earnings per share (eps) and whether there is any funny business in the treatment of exceptional items (see Terry Smith's Accounting for Growth). Companies which make up their own definition of eps usually get the bargepole treatment).

Compare the company with the valuation put on its competitors and the earnings yield/price earnings ratio on long government bonds. Sometimes you can see the reasons why a company is more highly or less highly rated than its competitors.

What's the outlook for the company? Can I credibly visualise what the company is likely to look like in ten years time?

I avoid using complicated formulas. Valuing shares is as much an art as a science; too much maths creates a false sense of certainty in the valuation produced. I did enough modern portfolio theory to pass an exam but I've never used it.

Discounted cash flow (DCF) is moderately useful, though it puts a lot of faith in your assumptions once you get beyond a few years. DCF is very popular with people who like to value shares like bonds.

A quick look at the balance sheet, historical sales, earnings per share (eps) and whether there is any funny business in the treatment of exceptional items (see Terry Smith's Accounting for Growth). Companies which make up their own definition of eps usually get the bargepole treatment).

Compare the company with the valuation put on its competitors and the earnings yield/price earnings ratio on long government bonds. Sometimes you can see the reasons why a company is more highly or less highly rated than its competitors.

What's the outlook for the company? Can I credibly visualise what the company is likely to look like in ten years time?

I avoid using complicated formulas. Valuing shares is as much an art as a science; too much maths creates a false sense of certainty in the valuation produced. I did enough modern portfolio theory to pass an exam but I've never used it.

Discounted cash flow (DCF) is moderately useful, though it puts a lot of faith in your assumptions once you get beyond a few years. DCF is very popular with people who like to value shares like bonds.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: How do I value a share?

A value investor would say that it's the value of all future free cashflows discounted to the present.

Buffett gives the example that with a bond this is easy to do as all future cashflows are already known. With a company you are just trying to do the same thing, except that with companies its more difficult as they can grow their earnings (both positively and negatively) so it involves your best guess about how the company is going to do in the future, together with the discount rate you require for the risk you are taking on. This is the company's intrinsic value.

Buffett says that if you can't answer those questions then you can't but the stock, though you can "gamble" in it:

https://www.youtube.com/watch?v=Bxqre8vPYBo

Buffett gives the example that with a bond this is easy to do as all future cashflows are already known. With a company you are just trying to do the same thing, except that with companies its more difficult as they can grow their earnings (both positively and negatively) so it involves your best guess about how the company is going to do in the future, together with the discount rate you require for the risk you are taking on. This is the company's intrinsic value.

Buffett says that if you can't answer those questions then you can't but the stock, though you can "gamble" in it:

https://www.youtube.com/watch?v=Bxqre8vPYBo

-

Mike4

- Lemon Half

- Posts: 7203

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1666 times

- Been thanked: 3840 times

Re: How do I value a share?

dealtn wrote:Mike4 wrote:A really basic question I've been casting around for an answer to for a while now.

I will counter with another very basic question, which sits at the root of the answer to your (and many other) questions.

If you were offered the choice between £100 today and £100 in a year's time which would you prefer? More importantly, why?

What about £100 today and £101 in a year? £100 against £110, £150 ...?

Most will be able to see that (except in very unusual circumstances) £100 today is "better" than £100 in the future, but as the future amount increases, that preference shifts. This is the concept of future value of money, and it's inverse, discounting future cashflows back to today's value.

The next step is to consider the difference between (absolute) certain future cashflows, and uncertain ones, and how that should be adjusted for in that calculation.

Once that is grasped it is (simply!) a case of discounting those unknown, indeed unknowable, "risky" future cashflows into today's appropriate valuation.

For a share in a company there are 2 broad ways of doing this, but essentially the same thing. Either value the company (via its cashflows), or value the equity share via its cashflows. (It is very important to note there is a very big difference between valuing the company, and valuing the equity in the company - 2 very different things as companies, especially those big enough to be listed, often have more than a single source of capital).

Hopefully that is a starting point.

A HUGE thank you for that.

I have a terrible tendency to overcomplicate things and now I see the founding principles are actually quite simple.

But as scrumpy says, perhaps the biggest determinant is one's view of the prospects for the future, or what make and model of crystal ball one uses.

-

Mike4

- Lemon Half

- Posts: 7203

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1666 times

- Been thanked: 3840 times

Re: How do I value a share?

And also a HUGE thank you to Scrumpy, Salvor and vand all of whom have added more valuable insight.

Much of it obvious now they've said it, but this is something I notice with most wisdom. It only becomes obvious AFTER someone tells you.

Much of it obvious now they've said it, but this is something I notice with most wisdom. It only becomes obvious AFTER someone tells you.

-

moorfield

- Lemon Quarter

- Posts: 3552

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1585 times

- Been thanked: 1416 times

Re: How do I value a share?

monabri wrote:Have a look at Chapter 3 (~25 pages) in Phil Oakley's Book "How to Pick Quality Shares" (about £16 from Amazon).

Then there's Terry Smith's "Investing for Growth" (but maybe read the reviews)

However, from my point of view, I'm not clever enough/patient enough/have sufficient knowledge/time/contacts/resources so maybe I should just pay for the likes of Smith to do this for me?

I concur. Phil Oakley's book is very good and worth reading.

Terry Smith's book is 30 years old now, a lot of the accounting standards he discussed have since moved on I think.

-

GoSeigen

- Lemon Quarter

- Posts: 4430

- Joined: November 8th, 2016, 11:14 pm

- Has thanked: 1612 times

- Been thanked: 1604 times

Re: How do I value a share?

vand has hinted at this already, but learn about valuing bonds first, then move on to companies/shares. Bonds are easy, and a company is very much like a bond but with uncertain (variable) cashflows so the skills will be transferable.

GS

GS

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: How do I value a share?

In addition to DCF and all that, you need to be able to interpret a Balance Sheet and see just what sort of borrowings are in there, and indeed whether the assets are reasonably valued. Not so important for asset light companies but then you will want to see how they are valuing the intellectual property, goodwill and any other intangibles. Many financial services companies, banks especially, are not easy to interpret.

Dod

Dod

Re: How do I value a share?

I recommend 'The Long And The Short Of It' by John Kay, described as 'a guide to finance and investment for normally intelligent people not in the industry'.

There is an intro, a bit in the middle with the maths which the author describes as kind of optional and a round up.

The foreword pretty much tells you which bits to read.

The bit is the middle is the bit you are asking about.

I have no formal education in Economics beyond an A level, maths was ok 30 years ago. It isn't now, but I was alright.

Not some epic work either, a couple of hundred pages all in.

W.

There is an intro, a bit in the middle with the maths which the author describes as kind of optional and a round up.

The foreword pretty much tells you which bits to read.

The bit is the middle is the bit you are asking about.

I have no formal education in Economics beyond an A level, maths was ok 30 years ago. It isn't now, but I was alright.

Not some epic work either, a couple of hundred pages all in.

W.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3444 times

Re: How do I value a share?

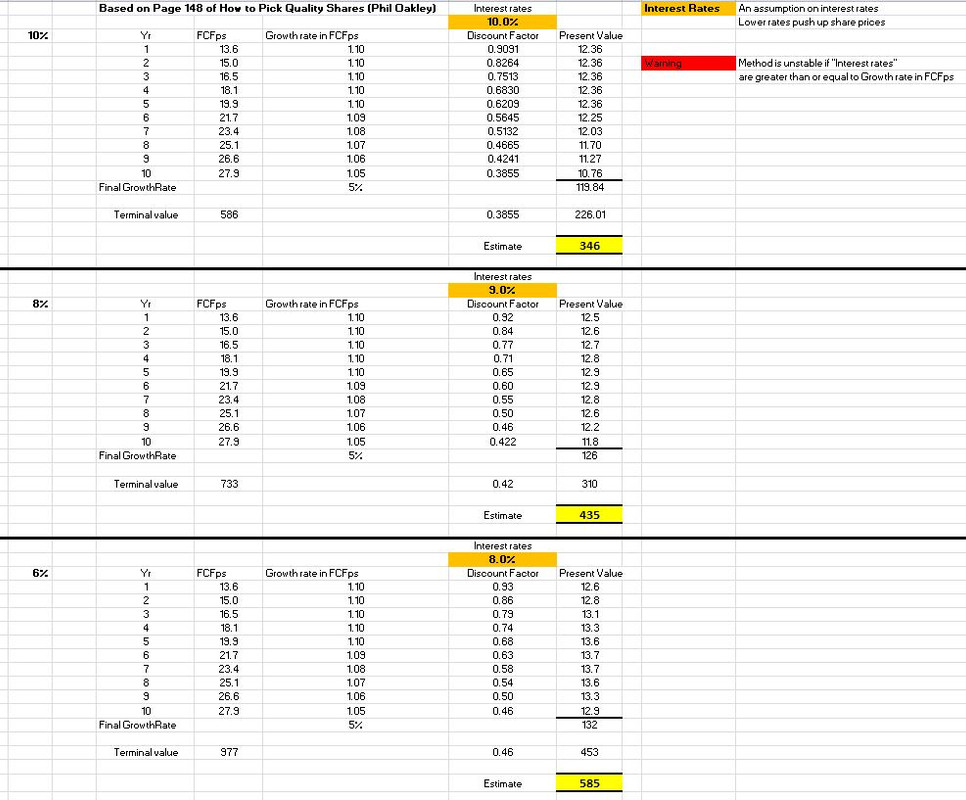

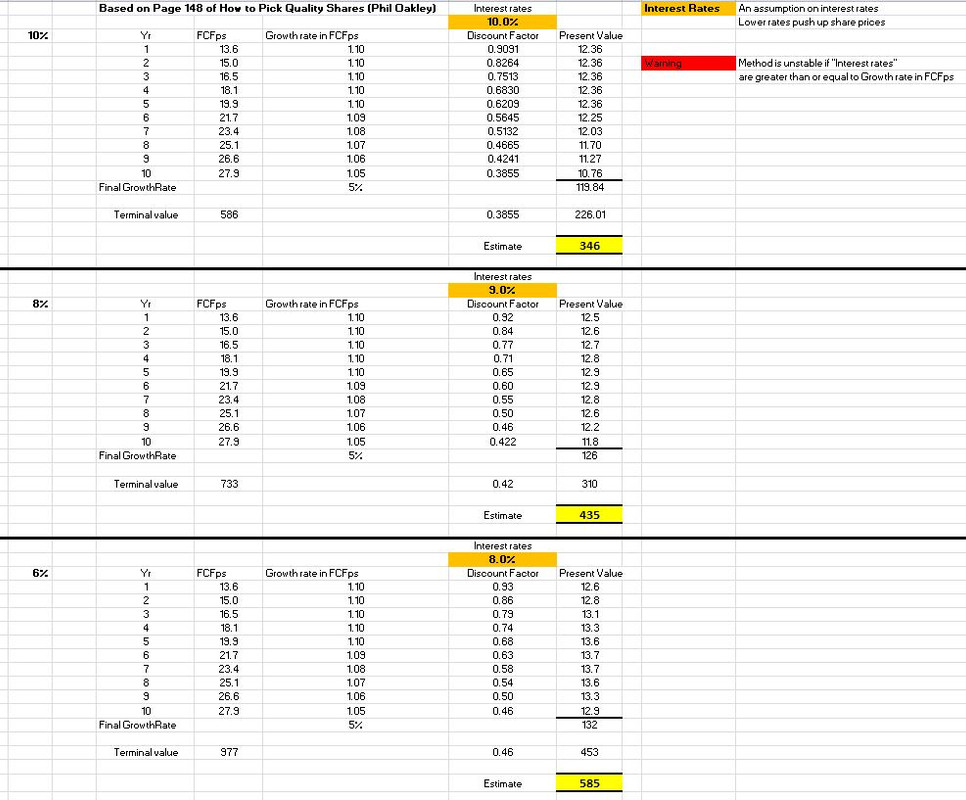

The Discounted Flow Method (DCF)

I took Phil Oakley's example for a well known Pizza Company as illustrated on P148 of his How to Pick Quality Shares.

The book was written a few years ago and his examples assume 10% growth in the Free cash Flow per share for 5 years and then a reduction of 1 percent per year for the next 5 years, at which point growth then continues at 5%. Comment : It's a bit of guess work because things come along such as, but not limited to, competition, inflation, recession, pandemics, buy outs, mergers, change in management, and the further out in time the greater the uncertainty.

"Interest rates" (This is the percentage we might want to achieve for the risk level) - Selection of the value is described as being worthy of a book in itself. He says that shares are more risky than saving accounts/banks and so an investor wants a higher interest rate (return) for the risk. The riskier the company the higher the "interest rate" figure for the calculation. He starts off with 10%, a round number but I've tweaked it to 9% or 8% for 3 scenarios.

Note: Lower bank rates mean that it is more difficult to get a good return in the building society so shares become attractive (coupled with the fact money is cheaper to borrow for the companies) and share prices should rise.

I'm reading "Interest rates" here as "Current bank Interest Rates + a Return". So, if current bank interest rates were 3%, I might want to set the "Interest rates" figure to a higher number, maybe 3% +7%?

The net result of these 3 scenarios is that we calculate an estimate for the value of a share to pay "now".

Small changes in assumptions (in this case, something that we have no control over, such as bank interest rate movements massively influence the estimate. Is the share worth 346p or 585p? What is the current shareprice?

On page 151, Oakley says "many professional investors do not bother going through this kind of exercise. They know they cannot accurately predict the future and that this kind of approach is only as good as the assumptions behind it".

I took Phil Oakley's example for a well known Pizza Company as illustrated on P148 of his How to Pick Quality Shares.

The book was written a few years ago and his examples assume 10% growth in the Free cash Flow per share for 5 years and then a reduction of 1 percent per year for the next 5 years, at which point growth then continues at 5%. Comment : It's a bit of guess work because things come along such as, but not limited to, competition, inflation, recession, pandemics, buy outs, mergers, change in management, and the further out in time the greater the uncertainty.

"Interest rates" (This is the percentage we might want to achieve for the risk level) - Selection of the value is described as being worthy of a book in itself. He says that shares are more risky than saving accounts/banks and so an investor wants a higher interest rate (return) for the risk. The riskier the company the higher the "interest rate" figure for the calculation. He starts off with 10%, a round number but I've tweaked it to 9% or 8% for 3 scenarios.

Note: Lower bank rates mean that it is more difficult to get a good return in the building society so shares become attractive (coupled with the fact money is cheaper to borrow for the companies) and share prices should rise.

I'm reading "Interest rates" here as "Current bank Interest Rates + a Return". So, if current bank interest rates were 3%, I might want to set the "Interest rates" figure to a higher number, maybe 3% +7%?

The net result of these 3 scenarios is that we calculate an estimate for the value of a share to pay "now".

Small changes in assumptions (in this case, something that we have no control over, such as bank interest rate movements massively influence the estimate. Is the share worth 346p or 585p? What is the current shareprice?

On page 151, Oakley says "many professional investors do not bother going through this kind of exercise. They know they cannot accurately predict the future and that this kind of approach is only as good as the assumptions behind it".

-

Lootman

- The full Lemon

- Posts: 18938

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6675 times

Re: How do I value a share?

scrumpyjack wrote:The trouble is that the key issue in valuing a share is your forecast of the company's future (for many years!). Obviously the past is of interest and the state of their balance sheet may indicate if they can last til the future arrives. The market generally is looking at the future, not the past.

So get a really good crystal ball

SalvorHardin wrote:What's the outlook for the company? Can I credibly visualise what the company is likely to look like in ten years time?

I avoid using complicated formulas. Valuing shares is as much an art as a science; too much maths creates a false sense of certainty in the valuation produced. I did enough modern portfolio theory to pass an exam but I've never used it.

I think there is a lot of truth in both those statements. And to express it a different way, you do not necessarily have to be able to value a share at all in order to be a successful investor. You simply need to develop a sense of where the business is heading, whereas fundamental analysis only really tells you where it has been.

Depending on the skills you have, and the skills you lack, it can be futile to spend hours poring over balance sheets. It's also rather boring. I would much rather invest using qualitative factors than quantitative factors, and use technical analysis over fundamental analysis. Not that I am saying it is better; only that it suits me better. And in fact I would rather look at price charts than company accounts.

I feel sure that there are some good answers in this topic about how to value a share, and that was the question being asked. But there are ways to invest that don't involve doing that at all. So to my mind the real question is one about your own skills and nature, and whether you should even try to value shares.

-

Mike4

- Lemon Half

- Posts: 7203

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1666 times

- Been thanked: 3840 times

Re: How do I value a share?

monabri wrote:Small changes in assumptions (in this case, something that we have no control over, such as bank interest rate movements massively influence the estimate. Is the share worth 346p or 585p? What is the current shareprice?

On page 151, Oakley says "many professional investors do not bother going through this kind of exercise. They know they cannot accurately predict the future and that this kind of approach is only as good as the assumptions behind it".

This highlights a fear I have. I do the fundamental analysis and decide the share is worth 346p to 585p depending on my range of assumptions. Then I look up the share price and find it is actually trading at £10 or £20, possibly due to too much money chasing too few shares in the market a a whole. How often does this happen?

I guess this fear is my underlying reason for asking the question in the first place, that it happens constantly, and the art of share picking is in finding rare cases price of the share not being 'irrationally exuberant'.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3444 times

Re: How do I value a share?

Mike4 wrote:monabri wrote:Small changes in assumptions (in this case, something that we have no control over, such as bank interest rate movements massively influence the estimate. Is the share worth 346p or 585p? What is the current shareprice?

On page 151, Oakley says "many professional investors do not bother going through this kind of exercise. They know they cannot accurately predict the future and that this kind of approach is only as good as the assumptions behind it".

This highlights a fear I have. I do the fundamental analysis and decide the share is worth 346p to 585p depending on my range of assumptions. Then I look up the share price and find it is actually trading at £10 or £20, possibly due to too much money chasing too few shares in the market a a whole. How often does this happen?

I guess this fear is my underlying reason for asking the question in the first place, that it happens constantly, and the art of share picking is in finding rare cases price of the share not being 'irrationally exuberant'.

How often ... I'm sure there are examples right now.

Imperial Brands (IMB) £17.10 vs £46.53 (DCF fair value)

British Amer Tobacco (BATS) £30.33 vs £69.45

Taylor Wimpey (TW) £1.54 vs £2.08

Spirax Sarco (SPX) £134 vs £73.70

Unilever (ULVR) £39.37 vs £46.28

Aviva (Av.) £4.36 vs £8.71

Renishaw (RSW) £46.54 vs £25.31

GSK £16.41 vs £39.88

The source of this data is https://simplywall.st/dashboard

SimplyWallStreet allow 5 free company reports per month (just supply an email address - no hassle from them). £8 per month for 30 company reports or £16 for unlimited company reports. All plans are Global markets (inc the free plan).

No affiliation with SwS other than as a customer on their £8/mnth plan.

The Sws Stock screener rapdily suggests shares where the DCF value is lower than the actual price for further investigation.

Who is online

Users browsing this forum: No registered users and 23 guests