https://www.investegate.co.uk/announcem ... rt/7768505 CONTINUED ACQUISITION MOMENTUM DRIVES ECONOMIC VALUE GROWTH AND POSITIVE CASH GENERATION

Chesnara reports its 2023 half year results. Key highlights for the period are:

· Completion of the acquisition of Conservatrix's insurance portfolio in the Netherlands

· Acquisition of an individual protection portfolio from Canada Life UK

· New UK strategic partnership with SS&C Technologies

· Positive Group commercial cash generation of £21.8m

· Robust solvency of 205%, materially above our 140-160% normal operating range

· Increased Economic value ("EcV") of £523.2m (347p per share)

· Improved commercial new business growth of £6.3m delivered

· IFRS profit before tax of £16.0m, and increase of CSM of £54.2m in the period

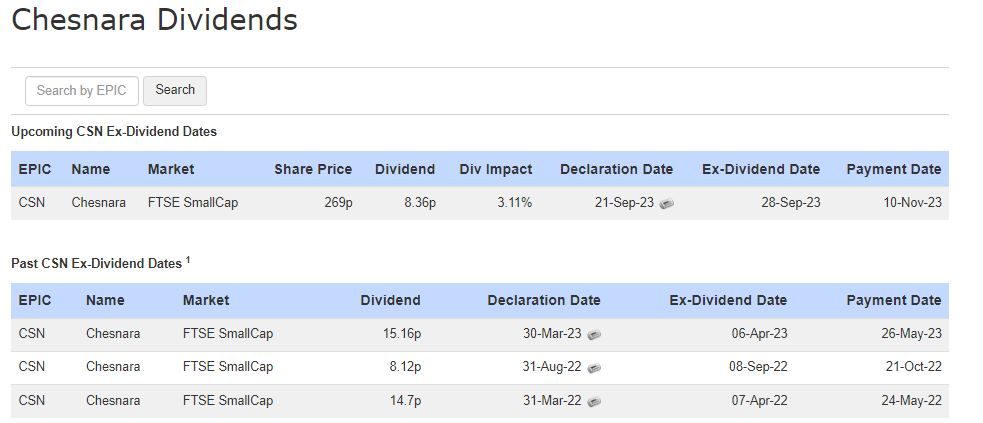

· 3% increase to the interim dividend to 8.36p per share; the 19th year of consecutive increases

All in all , looks quite positive to me!