An upcoming auction for seven UK offshore wind projects is set to flop, according to industry sources.

The results are due to be announced on Friday, but the number of bids will be close to zero, or none at all, the sources said.

Offshore wind developers have been saying the price set by the government for the electricity they will generate is too low to make projects viable.

The government said it was committed to increasing the use of renewable energy.

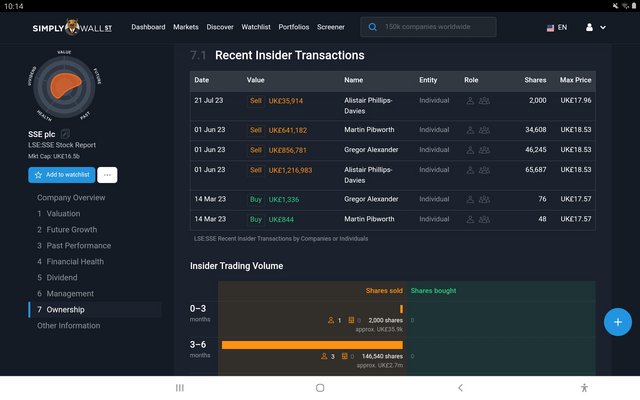

Energy firm SSE and Swedish firm Vattenfall have already ruled themselves out of the bidding, saying that the government had failed to allow for sharp rises in the cost of steel and labour when setting the electricity price.

Industry sources have told the BBC that if big, experienced and well-financed firms cannot make the sums work, it is unlikely that others will be able to.

Under its wind power auctions, the government sets an electricity price which bidders compete to come in at or below.

This arrangement is called a Contract for Difference (CFD). If electricity prices in the future rise above that level, the companies pay the excess back to the Treasury, if they fall below it the Treasury pays the company the difference.

The £44 per megawatt hour price floor set for this auction fails to take account of development costs, according to industry insiders. They have been warning for some time that steel prices and wage rises had pushed their costs up by between 20% and 40% since the last auction was held at a similar price target.

Electricity generators were also hit with a windfall tax on profits from older projects that pre-dated the Contract for Difference regime. SSE warned at the time that the tax would cause it to review future investment plans.

https://www.bbc.co.uk/news/business-66740920

Ian (Who no longer holds SSE as of two weeks ago due to the dividend situation).