Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Aviva (AV.)

Forum rules

No penny shares or promotional posts

No penny shares or promotional posts

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: Aviva (AV.)

https://www.aviva.com/newsroom/news-rel ... ouncement/

Dividend 20.7p, ex dividend 30 Mar 23, paid 18 May 23.

https://www.aviva.com/newsroom/news-rel ... ouncement/

https://static.aviva.io/content/dam/avi ... s-2022.pdf

Ian.

Strong results demonstrating benefits of diversified business model

General insurance gross written premiums (GWP) up 8%7 to £9,749m (20212: £8,807m) and COR‡ of 94.6% (20212: 92.9%)

UK & Ireland Life VNB‡ up 15% to £767m (2021: £668m) with sales6 of £33bn (2021: £36bn)

Operating profit‡,4 up 35% to £2,213m (20212: £1,634m)

Solvency II operating own funds generation‡ up 37% to £1,623m (20212: £1,187m)

Solvency II return on equity‡ 16.4% (20212: 10.7%)

Cash remittances‡ up 11% to £1,845m (20212: £1,662m)

Baseline controllable costs‡,5 down 3% to £2,771m (20212: £2,854m) reflecting continued focus on efficiency

IFRS loss of £(1,139)m (2021: £2,036m profit) largely reflects adverse market movements

Final dividend per share of 20.70p (2021: 14.70p). Total dividend per share of 31.00p (2021: 22.05p), as per previous guidance.

Dividend 20.7p, ex dividend 30 Mar 23, paid 18 May 23.

https://www.aviva.com/newsroom/news-rel ... ouncement/

https://static.aviva.io/content/dam/avi ... s-2022.pdf

Ian.

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: Aviva (AV.)

Aviva plc to commence buyback of its ordinary shares for up to a maximum aggregate consideration of £300 million.

https://www.investegate.co.uk/aviva-plc ... 01023687S/

Ian.

Aviva plc ("Aviva") announces it will commence a share buyback programme of its ordinary shares ("Shares") for up to a maximum aggregate consideration of £300 million1 (the "Programme"), commencing on 10 March 2023.

Aviva has entered into a non-discretionary agreement with Citigroup Global Markets Limited ("Broker") to undertake the Programme by making market purchases of the Shares. The Broker shall make trading decisions under the Programme independently of Aviva, as principal (except for Aviva's ability to terminate the Broker's mandate in certain limited circumstances). Shares acquired by the Broker will subsequently be sold on to Aviva and, to the extent permitted by law, such purchased Shares will be cancelled. The purpose of the Programme is therefore to reduce Aviva's share capital. The maximum number of Shares to be acquired under the Programme is 100 million1 and the Programme is expected to complete by 30 June 2023.

https://www.investegate.co.uk/aviva-plc ... 01023687S/

Ian.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

I note that the shares are going ex-dividend in this tax year...in recent years the Final dividend is ex-dividend just at the start of the new tax year. Perhaps they're trying to entice last minute buys in this tax year?

It seems strange that the metrics seem markedly improved and then

"IFRS loss of £(1,139)m (2021: £2,036m profit) largely reflects adverse market movements".

That's a heck of a swing!

It seems strange that the metrics seem markedly improved and then

"IFRS loss of £(1,139)m (2021: £2,036m profit) largely reflects adverse market movements".

That's a heck of a swing!

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

Based on the current shareprice, Aviva will be buying back a max of 67 million shares ( £300m / £4.46). This represents 67/3917 million , c.1.7%.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

There is an important point for dividends.

In the announcement, the CEO says:

"We are committed to delivering an attractive and sustainable dividend, and have upgraded our dividend guidance to low-to-mid single digit growth in the cash cost of the dividend"

A promise of more dividend jam ahead.

In the announcement, the CEO says:

"We are committed to delivering an attractive and sustainable dividend, and have upgraded our dividend guidance to low-to-mid single digit growth in the cash cost of the dividend"

A promise of more dividend jam ahead.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Aviva (AV.)

monabri wrote:There is an important point for dividends.

In the announcement, the CEO says:

"We are committed to delivering an attractive and sustainable dividend, and have upgraded our dividend guidance to low-to-mid single digit growth in the cash cost of the dividend"

A promise of more dividend jam ahead.

That is not really offering a lot surely? Dividend increases of between say 1% and 5%. Not giving too much away.

Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

Dod101 wrote:monabri wrote:There is an important point for dividends.

In the announcement, the CEO says:

"We are committed to delivering an attractive and sustainable dividend, and have upgraded our dividend guidance to low-to-mid single digit growth in the cash cost of the dividend"

A promise of more dividend jam ahead.

That is not really offering a lot surely? Dividend increases of between say 1% and 5%. Not giving too much away.

Dod

Yes, it's a bit 'flexible' in terms of future increases. At this stage, shareholders can expect a moderate increase in dividend..most likely to be sub inflation.

-

Bouleversee

- Lemon Quarter

- Posts: 4654

- Joined: November 8th, 2016, 5:01 pm

- Has thanked: 1195 times

- Been thanked: 903 times

Re: Aviva (AV.)

What exactly was returned to shareholders as a result of previous buyback round? The yield may look good on today's price but the s.p. was 1194 in July 1998 and 550 in May 2019 so not so brilliant for long term holders.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

Bouleversee wrote:What exactly was returned to shareholders as a result of previous buyback round? The yield may look good on today's price but the s.p. was 1194 in July 1998 and 550 in May 2019 so not so brilliant for long term holders.

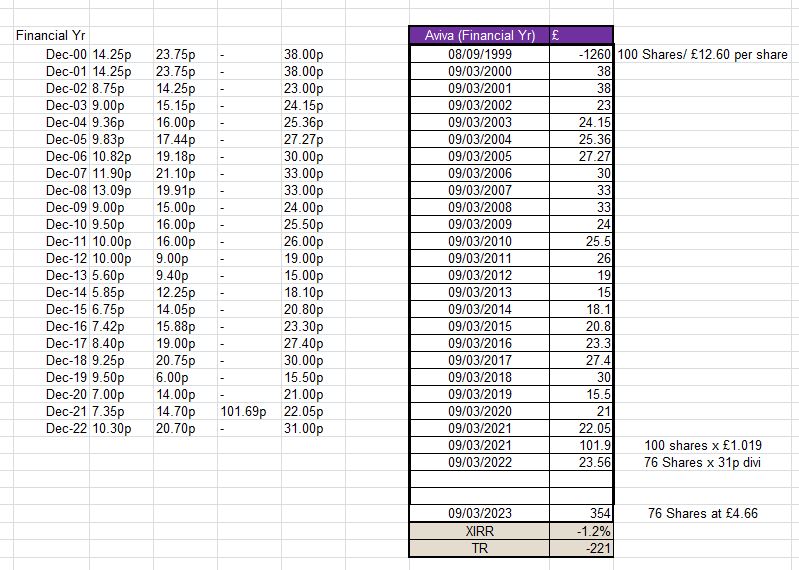

Ballpark calc/ rough and ready. Purchasing 100 shares in Sept 1999 just after the ex dividend date with a share price of £12.60 per share, calculating the annual dividend and accounting for the return of £1.01 per share and the subsequent reduction to 76 shares...

Not very good overall! A total return of negative £221.

Initial outlay of £1260.

£583 in dividends + £101.9 returned and a current value of £354 (76 * £4.66).

Industrial summary - starts with two letters, both starting with the letter "p".

-

scrumpyjack

- Lemon Quarter

- Posts: 4862

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 617 times

- Been thanked: 2706 times

Re: Aviva (AV.)

I have held them for a similar period and it does illustrate what a 'value trap' is and why insurers can rightly be so lowly rated by the market.

There have been so many false dawns at Aviva and holding the shares has long been a triumph of hope over experience!

Having said that, I continue to hold because I think Amanda Blanc has finally tackled their problems head on, where no previous CEO has had the guts, and so far it does look better. I wouldn't buy more because I don't have enough confidence that there will be a sustained year after year improvement and a return in the SP to £12

There have been so many false dawns at Aviva and holding the shares has long been a triumph of hope over experience!

Having said that, I continue to hold because I think Amanda Blanc has finally tackled their problems head on, where no previous CEO has had the guts, and so far it does look better. I wouldn't buy more because I don't have enough confidence that there will be a sustained year after year improvement and a return in the SP to £12

-

IanTHughes

- Lemon Quarter

- Posts: 1790

- Joined: May 2nd, 2018, 12:01 pm

- Has thanked: 730 times

- Been thanked: 1117 times

Re: Aviva (AV.)

scrumpyjack wrote:I have held them for a similar period and it does illustrate what a 'value trap' is and why insurers can rightly be so lowly rated by the market.

There have been so many false dawns at Aviva and holding the shares has long been a triumph of hope over experience!

My experience of Aviva is rather different from yours.

First of all, here is how my holding was built ……

Date | Price (p) | Holding | Yield

10-Feb-12 | 363.9780 | 64.88% | 7.14%

10-Oct-19 | 378.3265 | 9.68% | 8.00%

10-Dec-19 | 403.9600 | 5.67% | 7.49%

10-Jan-20 | 415.3760 | 5.08% | 7.28%

10-Feb-20 | 405.9278 | 14.70% | 7.45%

The holding currently shows a capital profit of 21.50%. Furthermore, taking all cash flows into account, the annualised growth rate, as measured by XIRR, is +7.69%. Not exceptional I grant you, but also not what I would call evidence of having stumbled into a "value trap". Even the dividend, over the last 10 years, has shown an annualised increase of 5.02%, although it has been a roller-coaster ride, to say the very least.

Year End |Dividend| 1 Year | 3 Years | 5 Years | 10 Years | 20 Years

31-Dec-22 | 31.00 | 40.59% | 25.99% | 2.50% | 5.02% | 1.50%

31-Dec-21 | 22.05 | 5.00% | -9.75% | -1.10% | -1.63% | -2.68%

31-Dec-20 | 21.00 | 35.48% | -8.49% | 0.19% | -1.92% | -2.92%

31-Dec-19 | 15.50 | -48.33% | -12.70% | -3.05% | -4.28% |

31-Dec-18 | 30.00 | 9.49% | 12.98% | 14.87% | -0.95% |

31-Dec-17 | 27.40 | 17.60% | 14.82% | 7.60% | -1.84% |

31-Dec-16 | 23.30 | 12.02% | 15.81% | -2.17% | -2.50% |

31-Dec-15 | 20.80 | 14.92% | 3.06% | -3.99% | -2.67% |

31-Dec-14 | 18.10 | 20.67% | -11.37% | -5.49% | -3.32% |

31-Dec-13 | 15.00 | -21.05% | -16.21% | -14.59% | -4.65% |

31-Dec-12 | 19.00 | -26.92% | -7.49% | -10.45% | -1.89% |

31-Dec-11 | 26.00 | 1.96% | -7.64% | -2.82% | -3.72% |

Enjoy!

Ian

-

scrumpyjack

- Lemon Quarter

- Posts: 4862

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 617 times

- Been thanked: 2706 times

Re: Aviva (AV.)

You are fortunate not to have bought them 13 years earlier when the SP was over 1200p and the dividend, as I recall, 44p!

It was called Commercial Union then. So yes, if you buy at the bottom of the dead cat bounce, things can look fine for a while after the cat bounces

It was called Commercial Union then. So yes, if you buy at the bottom of the dead cat bounce, things can look fine for a while after the cat bounces

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Aviva (AV.)

scrumpyjack wrote:I have held them for a similar period and it does illustrate what a 'value trap' is and why insurers can rightly be so lowly rated by the market.

There have been so many false dawns at Aviva and holding the shares has long been a triumph of hope over experience!

Having said that, I continue to hold because I think Amanda Blanc has finally tackled their problems head on, where no previous CEO has had the guts, and so far it does look better. I wouldn't buy more because I don't have enough confidence that there will be a sustained year after year improvement and a return in the SP to £12

...yet more hope against experience

PS - I'm in the same boat, so this is aimed at me as much as anyone.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Aviva (AV.)

My case: first bought 2007 and added several times. Still 10% down but with dividends my TR is 2.17%.

Not a bundle of laughs, but not Carillion.

Arb.

Not a bundle of laughs, but not Carillion.

Arb.

-

Alaric

- Lemon Half

- Posts: 6068

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1419 times

Re: Aviva (AV.)

scrumpyjack wrote:It was called Commercial Union then.

It had been a merger with the demutualised Norwich Union. I wonder how shareholders from Norwich Union fared.

https://www.theguardian.com/money/1999/ ... .business2

-

triatharoo

- Posts: 26

- Joined: January 29th, 2017, 11:23 am

- Has thanked: 87 times

- Been thanked: 13 times

Re: Aviva (AV.)

So what is this about then?

https://static.aviva.io/content/dam/avi ... r-2023.pdf

Is this normal? Seems like they have about £5b sitting in a couple of ledgers that they want to move to normal funds. I've not seen it before - is it anything to be investigated further?

Edit: Just noticed that it was issued in March, but I was away then and missed it. The lack of comment since then leads me to believe it is perfectly normal.

Proposed Capital Reduction

1. Introduction

I am writing to you on behalf of the Board to inform you of a general meeting of the Company to be held after the 2023 AGM on

Thursday, 4 May 2023 at 1pm (or 30 minutes after the 2023 AGM is concluded or adjourned, whichever is later) at which you will be

asked to consider and vote on certain resolutions of the Company. These resolutions are in respect of the proposal to reduce the

share premium account and the capital redemption reserve of the Company.

The purpose of this Circular is to give you details of, including the background to and reasons for, the Capital Reduction, and

to explain why the Board considers this to be in the best interests of the Company, the Shareholders and the Company’s other

stakeholders taken as a whole.

I encourage you to read the questions and answers on the Capital Reduction in Part II (Questions and Answers on the Capital

Reduction) which have been prepared to help you understand what the Capital Reduction involves.

https://static.aviva.io/content/dam/avi ... r-2023.pdf

Is this normal? Seems like they have about £5b sitting in a couple of ledgers that they want to move to normal funds. I've not seen it before - is it anything to be investigated further?

Edit: Just noticed that it was issued in March, but I was away then and missed it. The lack of comment since then leads me to believe it is perfectly normal.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Aviva (AV.)

Page 10, point 6:

"6. Are capital reductions commonly undertaken by other companies?

Yes. It is common practice for companies incorporated in England and Wales (including public limited companies such as Aviva) to undertake capital reductions, whether in order to improve their distributable reserves position or for other reasons."

Point 5 on page 10.

"The Capital Reduction will increase the Company’s distributable reserves, which can be used for purposes such as dividend distributions and share buybacks, thus providing greater

flexibility going forwards."

It seems a bit smoke & mirrors but hopefully someone will be along to comment further!

I'm not a financial accountant so I take the announcement at face value and trust the management to be doing the right thing for shareholders.

"6. Are capital reductions commonly undertaken by other companies?

Yes. It is common practice for companies incorporated in England and Wales (including public limited companies such as Aviva) to undertake capital reductions, whether in order to improve their distributable reserves position or for other reasons."

Point 5 on page 10.

"The Capital Reduction will increase the Company’s distributable reserves, which can be used for purposes such as dividend distributions and share buybacks, thus providing greater

flexibility going forwards."

It seems a bit smoke & mirrors but hopefully someone will be along to comment further!

I'm not a financial accountant so I take the announcement at face value and trust the management to be doing the right thing for shareholders.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Aviva (AV.)

monabri wrote:Page 10, point 6:

"6. Are capital reductions commonly undertaken by other companies?

Yes. It is common practice for companies incorporated in England and Wales (including public limited companies such as Aviva) to undertake capital reductions, whether in order to improve their distributable reserves position or for other reasons."

Point 5 on page 10.

"The Capital Reduction will increase the Company’s distributable reserves, which can be used for purposes such as dividend distributions and share buybacks, thus providing greater

flexibility going forwards."

It seems a bit smoke & mirrors but hopefully someone will be along to comment further!

I'm not a financial accountant so I take the announcement at face value and trust the management to be doing the right thing for shareholders.

An accountant would/should e able to provide the answer but I suspect that it is buried in the fine print of a Companies Act.

Alliance Trust recently did so as well or at least they got Court permission to change I think it was a Merger Reserve into distributable reserves. It was a capital reduction in the sense of abolishing one Reserve, designated as capital (which cannot of course be distributed and got it changed to something else, a distributable reserve which of course could).

Aviva is doing something similar. In effect it is allowing for more flexibility in the way they can use their assets, such as for dividends, and probably more likely, share buybacks.

I do not think that shareholders are being in the least disadvantaged by this by I am not an accountant.

Dod

-

scrumpyjack

- Lemon Quarter

- Posts: 4862

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 617 times

- Been thanked: 2706 times

Re: Aviva (AV.)

I haven't looked at this but it sounds quite normal after the various capital events that have happened at Aviva. They have disposed of lots of businesses and returned most of the proceeds to shareholders as capital. That's fine. But such activities can result in difficulties with the split of the company's capital between share capital, capital reserves and distributable reserves. The first two of those cannot be paid in dividends whilst the last can be. So I would guess this is to do with rearranging the split between those categories of book capital to be more convenient. No cash is involved.

Return to “Company Share news (LSE Main Market)”

Who is online

Users browsing this forum: No registered users and 42 guests