Maybe I should just buy MRCH instead

Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Admiral Group (ADM)

Forum rules

No penny shares or promotional posts

No penny shares or promotional posts

-

Gerry557

- Lemon Quarter

- Posts: 2057

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 567 times

Re: Admiral Group (ADM)

Oouhh! I have been doing the same, selling Bae and buying here.

Maybe I should just buy MRCH instead

Maybe I should just buy MRCH instead

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: Admiral Group (ADM)

Admiral Group plc reports resilient 2022 full year results against a backdrop of high inflation.

https://www.investegate.co.uk/admiral-g ... 0000H6836/

Ian (I hold).

Comment from Milena Mondini de Focatiis , Group Chief Executive Officer:

“I am proud of the agility and adaptability that Admiral demonstrated in 2022 as it increased its customer base by 11% and delivered profits of £469 million against the backdrop of a challenging market environment.

“We have yet again shown focus and discipline, reacting quickly to emerging trends – we implemented price increases ahead of others in response to higher inflation whilst maintaining a conservative approach to reserving and capital management.

“We continued to make progress on our diversification strategy with Admiral Money making its first profit, continued growth across the Group particularly in new products, and growing new partnerships and distribution channels in international insurance which now has over two million customers.

“We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose. We continue to invest in our data and technology capabilities to be sure that we serve our customers better. I would like to thank all my colleagues across the Group for their hard work and dedication.

“And today we continue to be well-positioned for when the market improves given the combination of our proven competencies in underwriting and distribution, our willingness to innovate and to test-and-learn, and our commitment to people.”

And later;

Final d ividend

The Board has proposed a final dividend of 52.0 pence per share (2021: 72.0 pence per share, plus 46.0 pence per share special dividend from the sale of Penguin Portals) representing a normal dividend (65% of post-tax profits) of 37.5 pence per share and a special dividend of 14.5 pence per share. The dividend will be paid on 2 June 2023. The ex-dividend date is 4 May 2023 and the record date is 5 May 2023

https://www.investegate.co.uk/admiral-g ... 0000H6836/

Ian (I hold).

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

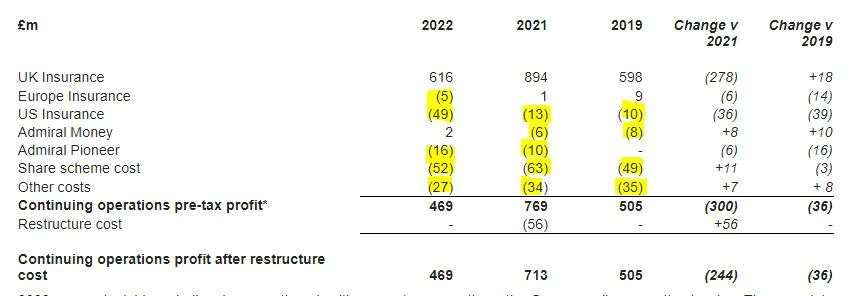

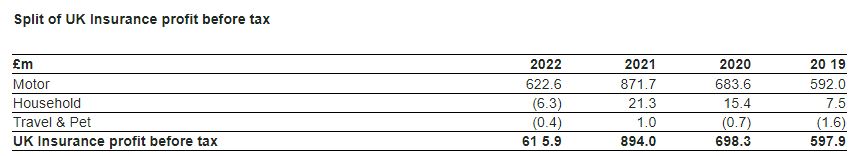

Now we know why the share price has made no progress in the last year or two. Now they have resorted to comparing the 2022 results with 2019 and even then they are behind! The argument is of course that 2020 in particular was an exceptional year because of the lockdown. 2021 was also good but this last year has been awful; they call it resillient.

Dod

Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Admiral Group (ADM)

At least they didn't cut the dividend to the extent Direct Line did! But..overall, not very good.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

monabri wrote:At least they didn't cut the dividend to the extent Direct Line did! But..overall, not very good.

They remain, for all their bluster, a one trick pony, UK motor insurance. If that goes wrong they are stuffed.

Dod

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: Admiral Group (ADM)

Dod101 wrote:monabri wrote:At least they didn't cut the dividend to the extent Direct Line did! But..overall, not very good.

They remain, for all their bluster, a one trick pony, UK motor insurance. If that goes wrong they are stuffed.

Dod

I agree with both of you. The market seems to too with the ADM SP being down almost 5% as I type. This won't stop me from holding ADM though, which I topped up twice last year. I'm thinking longer term than just today.

Ian.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Admiral Group (ADM)

Milena Mondini

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

monabri wrote:Milena Mondini

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

I did not pick that up. An email is required on that one, although I suspect that the phrase has just come out wrongly

Dod

-

everhopeful

- 2 Lemon pips

- Posts: 213

- Joined: November 9th, 2016, 12:18 pm

- Has thanked: 9 times

- Been thanked: 87 times

Re: Admiral Group (ADM)

I hold these and insure my cars with them as well. I am aware that the company looks after its employees and gives good value and good service to its customers. I like a company that does these things and would expect it to be beneficial to the long term performance.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

everhopeful wrote:I hold these and insure my cars with them as well. I am aware that the company looks after its employees and gives good value and good service to its customers. I like a company that does these things and would expect it to be beneficial to the long term performance.

The trouble is that they are a one trick pony. They made a net profit of £622 million from UK motor insurance. Everything else that they do except for a tiny profit from UK Money is losing money and has never I think made a profit. Against that UK Motor profit, the Group Profit is only £469 million so they are losing/squandering £153 million on the rest of world plus UK Household

Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Admiral Group (ADM)

Dod101 wrote:everhopeful wrote:I hold these and insure my cars with them as well. I am aware that the company looks after its employees and gives good value and good service to its customers. I like a company that does these things and would expect it to be beneficial to the long term performance.

The trouble is that they are a one trick pony. They made a net profit of £622 million from UK motor insurance. Everything else that they do except for a tiny profit from UK Money is losing money and has never I think made a profit. Against that UK Motor profit, the Group Profit is only £469 million so they are losing/squandering £153 million on the rest of world plus UK Household

Dod

You're (Dod) correct to highlight this. I've ringed the loss making "diworsification" of the business. Sooner or later the white flag will have to be played...surely? Take away these elements and the profit pre tax would have increased from £469m by £147m...a not inconsiderable chunk of change!

The share scheme is far too generous....I would say the business is being run for the benefit of the employees but I know better as the CEO has already stated the core focus

source : https://www.investegate.co.uk/admiral-g ... 0000H6836/

source : https://www.investegate.co.uk/admiral-g ... 0000H6836/

I'm surprised TBH....I would contend that this is currently not a well run business.

Travel & Pet Insurance ....

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

Agreed monabri. And if you want another note of caution, just take a look at the reinsurance and coinsurance arrangements and the risk free commissions they have in place, almost entirely reliant on the goodwill of Munichre, and we know that they have been selling down their shareholding in recent years.

I have said before that they are not an insurer, they are an underwriting agent essentially for their co and reinsurers. I think they are now beginning to run out of road. Do not listen or at least take with a pinch of salt the words of the CEO and the Chairperson.

I had not noticed the cost of their employee share scheme. That is ridiculous.

Dod

I have said before that they are not an insurer, they are an underwriting agent essentially for their co and reinsurers. I think they are now beginning to run out of road. Do not listen or at least take with a pinch of salt the words of the CEO and the Chairperson.

I had not noticed the cost of their employee share scheme. That is ridiculous.

Dod

-

88V8

- Lemon Half

- Posts: 5843

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4199 times

- Been thanked: 2603 times

Re: Admiral Group (ADM)

Dod101 wrote:monabri wrote:At least they didn't cut the dividend to the extent Direct Line did! But..overall, not very good.

They remain, for all their bluster, a one trick pony, UK motor insurance. If that goes wrong they are stuffed.

I sold them for CGT in October, and was pleased to buy back in at a time when so many other shares had suddenly risen.

At least I now hold fewer than before

I suppose the exit .. when was it... 18 months ago?... of their long-time partner, Munich Re, should have been a red flag.

V8

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

88V8 wrote:Dod101 wrote:monabri wrote:At least they didn't cut the dividend to the extent Direct Line did! But..overall, not very good.

They remain, for all their bluster, a one trick pony, UK motor insurance. If that goes wrong they are stuffed.

I sold them for CGT in October, and was pleased to buy back in at a time when so many other shares had suddenly risen.

At least I now hold fewer than before

I suppose the exit .. when was it... 18 months ago?... of their long-time partner, Munich Re, should have been a red flag.

V8

I do not think that Munichre re have (yet) entirely exited and they have been selling down for some time.

And Admiral has been losing money on other than the UK for a long time.

They had a brilliant strategy at start up but they do not appear to be able to replicate it overseas. They have though in the UK at least, a decent enough business and they do not have the baggage that say Aviva has.

Dod

-

idpickering

- The full Lemon

- Posts: 11383

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5801 times

Re: Admiral Group (ADM)

Dod101 wrote:

I do not think that Munichre re have (yet) entirely exited and they have been selling down for some time.

And Admiral has been losing money on other than the UK for a long time.

They had a brilliant strategy at start up but they do not appear to be able to replicate it overseas. They have though in the UK at least, a decent enough business and they do not have the baggage that say Aviva has.

Dod

Aviva are putting out their Finals tomorrow, so We'll see soon enough.

Ian.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

idpickering wrote:Dod101 wrote:

I do not think that Munichre re have (yet) entirely exited and they have been selling down for some time.

And Admiral has been losing money on other than the UK for a long time.

They had a brilliant strategy at start up but they do not appear to be able to replicate it overseas. They have though in the UK at least, a decent enough business and they do not have the baggage that say Aviva has.

Dod

Aviva are putting out their Finals tomorrow, so We'll see soon enough.

Ian.

Good, well they should be good after the rationalising they have been doing.

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

I wrote by snail mail to the Chair, Annette Court on 8 March, and this morning have had an email response (on Admiral notepaper) from the lady herself. That in itself is impressive.

I will need to look more carefully at the results because she tells me that the Italian business is consistently profitable but the fact is that most of their overseas business is losing money.

Re the cost of the employee share scheme, the costs are she says justified by the fact that a large proportion of staff remuneration is linked to the scheme, and, as I acknowledged in my letter to her, the staff share in the reduced dividend and share price. I still think that paying out well over 10% of Group profit to fund the staff share scheme is too much. However, I cannot judge it. That is for the management to judge, subject in the end on shareholders approving the Report and Accounts.

Others may be interested.

Dod

I will need to look more carefully at the results because she tells me that the Italian business is consistently profitable but the fact is that most of their overseas business is losing money.

Re the cost of the employee share scheme, the costs are she says justified by the fact that a large proportion of staff remuneration is linked to the scheme, and, as I acknowledged in my letter to her, the staff share in the reduced dividend and share price. I still think that paying out well over 10% of Group profit to fund the staff share scheme is too much. However, I cannot judge it. That is for the management to judge, subject in the end on shareholders approving the Report and Accounts.

Others may be interested.

Dod

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Admiral Group (ADM)

monabri wrote:Milena Mondini

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

Are you suggesting that companies do not prosper by looking after both customers and employees? If so, you need to re-evaluate your outlook on life.

Arb.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Admiral Group (ADM)

Arborbridge wrote:monabri wrote:Milena Mondini

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

Are you suggesting that companies do not prosper by looking after both customers and employees? If so, you need to re-evaluate your outlook on life.

Arb.

I appreciate that your question is posed to monabri but I doubt that they actually meant quite that. If you read the comments in context you will see what I mean. (I am not going native). The core purpose in running a business is or used to be to provide a good investment return for shareholders. I am old fashioned enough to think that that is or should still be so because without shareholders getting a decent return there is no business.

If you made the core purpose looking after your employees, you would be bankrupt very soon. That is not to say they should not be well looked after but my question is whether that is costing too much at Admiral.

Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Admiral Group (ADM)

Arborbridge wrote:monabri wrote:Milena Mondini

"We are aware that this has also been a challenging year for our customers and our people and looking after them is our core purpose."

She needs to re-evaluate the core purpose of running a business!

Are you suggesting that companies do not prosper by looking after both customers and employees? If so, you need to re-evaluate your outlook on life.

Arb.

No, just that the core purpose of running a commercial business is to make money. Of course, not at any cost. How this is achieved and the balances is up to the senior management team. Customers not happy..they will vote with their wallet, employees not happy..hopefully they will address the issues via their Union or in other ways ( no one wants to work for a long period for a bad employer). Ultimately, I want to invest in companies that make a profit and pay me a dividend/ total return.

Return to “Company Share news (LSE Main Market)”

Who is online

Users browsing this forum: No registered users and 47 guests