Page 1 of 10

Primary Health Properties (PHP)

Posted: May 11th, 2020, 11:01 am

by idpickering

Portfolio Acquisition & Rental Collection Update.

Portfolio acquisition

Primary Health Properties PLC ("PHP" or the "Company"), one of the UK's leading investors in modern primary healthcare facilities, announces that it has acquired a portfolio of 20 purpose-built medical centres, located across England and Wales, for a price of £47.1 million, before costs. As part of the same transaction, PHP has conditionally contracted to acquire a further two medical centres for £6.9 million, before costs.

The acquired properties are leased to GP practices, other NHS healthcare operators and pharmacies, with approximately 91% of the rental income being government backed and substantially all of the leases are reviewed to the open market on a three-yearly cycle.

This acquisition will increase PHP's portfolio in the UK and Ireland to a total of 510 assets with a gross value of just under £2.5 billion and a contracted rent roll of £131 million. Following completion of the portfolio acquisition and capital commitments PHP has undrawn loan facilities and cash totalling £289 million.

https://www.investegate.co.uk/primary-h ... 00103326M/

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 11:28 am

by Dod101

Thanks Ian. This REIT continues to be a good investment.

Dod

Re: Primary Health Properties (PHP)ore I gave

Posted: May 11th, 2020, 12:00 pm

by idpickering

Dod101 wrote:Thanks Ian. This REIT continues to be a good investment.

Dod

You’re welcome Dod. I was surprised that there wasn’t a company news board for these already, unless my eyes were deceiving me and I missed it lol. These are a newbie in my HYP as you might know, and I intend buying more of PHP soon. They’re a breath of fresh air after having held BLND and LAND in the recent past, before I dumped the pair of them.

Ian.

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 12:42 pm

by Dod101

Yes, tomorrow Land Securities (and Vodafone) announce their finals and B Land on Wednesday.

PHP is not very widely held, I suppose because the yield is not very high but a lot more dependable than some REITs.

Dod

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 12:50 pm

by jackdaww

Dod101 wrote:Yes, tomorrow Land Securities (and Vodafone) announce their finals and B Land on Wednesday.

PHP is not very widely held, I suppose because the yield is not very high but a lot more dependable than some REITs.

Dod

==========================

they were yielding around 5% in january .

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 12:55 pm

by Ricksure

First bought Primary Health Properties in 2016 topping up twice and have no complaints even showing a capital gain

For years I only ever bought high yielding shares for my SIPP but about ten years ago I looked into buying funds and decided against it however thought it might be a good idea to have a few quality lower-yielding shares and bought, Prudential, Unilever and later RB. I don't know where the idea for PHP came from more than likely a mention on Lemon Fool but it sat on my watch list for a long time until I bought and well pleased I did as a small dividend is a lot better than a canceled dividend

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 3:10 pm

by idpickering

Dod101 wrote:Yes, tomorrow Land Securities (and Vodafone) announce their finals and B Land on Wednesday.

PHP is not very widely held, I suppose because the yield is not very high but a lot more dependable than some REITs.

Dod

Without wanting to sound like a Dod groupie, I’m getting to realise the wisdom of your “don’t chase the higher yields” comments over on HYP Practical Board. I’m coming to terms with the fact that even lower yields compound over time too, and they’re perhaps safer investments as well?

Ian.

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 5:31 pm

by richfool

idpickering wrote:Dod101 wrote:Yes, tomorrow Land Securities (and Vodafone) announce their finals and B Land on Wednesday.

PHP is not very widely held, I suppose because the yield is not very high but a lot more dependable than some REITs.

Dod

Without wanting to sound like a Dod groupie, I’m getting to realise the wisdom of your “don’t chase the higher yields” comments over on HYP Practical Board. I’m coming to terms with the fact that even lower yields compound over time too, and they’re perhaps safer investments as well?

Ian.

I too hold PHP and have done for many years and topped up back in the falls at the end of February.

If there is one thing I have learned over the years, it's the importance of diversification, and that doesn't just mean diversification across sectors or even geographies, but includes diversification across asset classes and across growth investments, as well as income investments. I also look at the quality and defensiveness of investments, which is where PHP fits for me.

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 5:53 pm

by idpickering

richfool wrote:I too hold PHP and have done for many years and topped up back in the falls at the end of February.

If there is one thing I have learned over the years, it's the importance of diversification, and that doesn't just mean diversification across sectors or even geographies, but includes diversification across asset classes and across growth investments, as well as income investments. I also look at the quality and defensiveness of investments, which is where PHP fits for me.

Thanks for your input richfool. You made some great points there. I'm looking forward to hanging onto my PHP shares for many years. I'm a mere pup at 58 years old...

Ian.

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 7:14 pm

by shetland

I hold PHP and am thinking of selling. It’s performance has been phenomenal but this means that it is selling at something like a 45% premium to net asset value. While the company continues to increase its property portfolio this is done by issuing more capital or by increasing borrowings. The potential for a significant fall in share price is enormous.

Re: Primary Health Properties (PHP)

Posted: May 11th, 2020, 8:46 pm

by idpickering

shetland wrote:I hold PHP and am thinking of selling. It’s performance has been phenomenal but this means that it is selling at something like a 45% premium to net asset value. While the company continues to increase its property portfolio this is done by issuing more capital or by increasing borrowings. The potential for a significant fall in share price is enormous.

Thanks for your input and words of caution.

Ian.

Re: Primary Health Properties (PHP)

Posted: May 12th, 2020, 10:59 am

by richfool

PHP's yield has been driven down by its capital growth. The yield currently is c 3.5% according to HL and dividends have been increasing. I don't see what there is not to like.

The HL factsheet indicates that 1 out of 5 brokers recommend PHP as a Buy and 4 out of 5 brokers recommend it as a Strong Buy. (I.e. no neutrals or sells).

https://www.hl.co.uk/shares/shares-sear ... ary-shares

Re: Primary Health Properties (PHP)

Posted: May 12th, 2020, 12:08 pm

by Dod101

richfool wrote:PHP's yield has been driven down by its capital growth. The yield currently is c 3.5% according to HL and dividends have been increasing. I don't see what there is not to like.

The HL factsheet indicates that 1 out of 5 brokers recommend PHP as a Buy and 4 out of 5 brokers recommend it as a Strong Buy. (I.e. no neutrals or sells).

https://www.hl.co.uk/shares/shares-sear ... ary-shares

If so many brokers are recommending it, that is surely a warning to be careful.

OTOH I rather like it and have done for some years. The biggest bugbear I have is that it has a big appetite for fresh funding because unlike a conventional property company it does not trade any of its assets so a new investment usually means new funds or increased borrowings. These are quite high anyway but I guess can be sustained because of the security of the income. The new funds tend to be via placings which dilutes existing retail holders.

Dod

Re: Primary Health Properties (PHP)

Posted: May 12th, 2020, 12:13 pm

by Dod101

shetland wrote:I hold PHP and am thinking of selling. It’s performance has been phenomenal but this means that it is selling at something like a 45% premium to net asset value. While the company continues to increase its property portfolio this is done by issuing more capital or by increasing borrowings. The potential for a significant fall in share price is enormous.

Read your post after I made my own in response to Richfool. No intention of stealing your points.

As you can gather I agree with you about the funding but although there is a potential for stagnation in the share price I would be surprised if there is much real selling because it will be held by investors seeking a reliable income and that is in short supply at the moment.

Dod

Re: Primary Health Properties (PHP)

Posted: May 28th, 2020, 4:49 pm

by idpickering

Forward Funding Acquisition of New Primary Care Centre at Arklow, Co. Wicklow, Ireland .

Primary Health Properties PLC ("PHP" or the "Group"), one of the UK's leading investors in modern primary healthcare facilities, announces that it has contracted to provide development funding for the construction and acquisition of a purpose-built primary care centre in Arklow, Co. Wicklow, Ireland for an anticipated total cost of €18.0 million.

https://www.investegate.co.uk/primary-h ... 00041400O/

Re: Primary Health Properties (PHP)

Posted: June 25th, 2020, 7:11 am

by idpickering

Notice of Interim Dividend

The Company announces that the third quarterly interim dividend in 2020 of 1.475 pence per ordinary share of 12.5 pence each will be paid on 21 August 2020 to shareholders on the register on 3 July 2020. The dividend will comprise a Property Income Distribution (PID) of 1.275 pence per share and an ordinary dividend of 0.2 pence per share. The Company will be offering a scrip alternative with this dividend.

https://www.investegate.co.uk/primary-h ... 00079960Q/Also posted on HYP Practical Board.

Ian.

Re: Primary Health Properties (PHP)

Posted: June 25th, 2020, 7:19 am

by Dod101

idpickering wrote:Notice of Interim Dividend

The Company announces that the third quarterly interim dividend in 2020 of 1.475 pence per ordinary share of 12.5 pence each will be paid on 21 August 2020 to shareholders on the register on 3 July 2020. The dividend will comprise a Property Income Distribution (PID) of 1.275 pence per share and an ordinary dividend of 0.2 pence per share. The Company will be offering a scrip alternative with this dividend.

https://www.investegate.co.uk/primary-h ... 00079960Q/Also posted on HYP Practical Board.

Ian.

Thanks. Yes they just keep on giving.

Dod

Re: Primary Health Properties (PHP)

Posted: June 25th, 2020, 7:27 am

by idpickering

Dod101 wrote:idpickering wrote:Notice of Interim Dividend

The Company announces that the third quarterly interim dividend in 2020 of 1.475 pence per ordinary share of 12.5 pence each will be paid on 21 August 2020 to shareholders on the register on 3 July 2020. The dividend will comprise a Property Income Distribution (PID) of 1.275 pence per share and an ordinary dividend of 0.2 pence per share. The Company will be offering a scrip alternative with this dividend.

https://www.investegate.co.uk/primary-h ... 00079960Q/Also posted on HYP Practical Board.

Ian.

Thanks. Yes they just keep on giving.

Dod

You're welcome Dod. I'm likely to top up my PHP holdings over the coming months.

Ian.

Re: Primary Health Properties (PHP)

Posted: June 25th, 2020, 9:43 am

by monabri

Dod101 wrote:Thanks. Yes they just keep on giving.

Dod

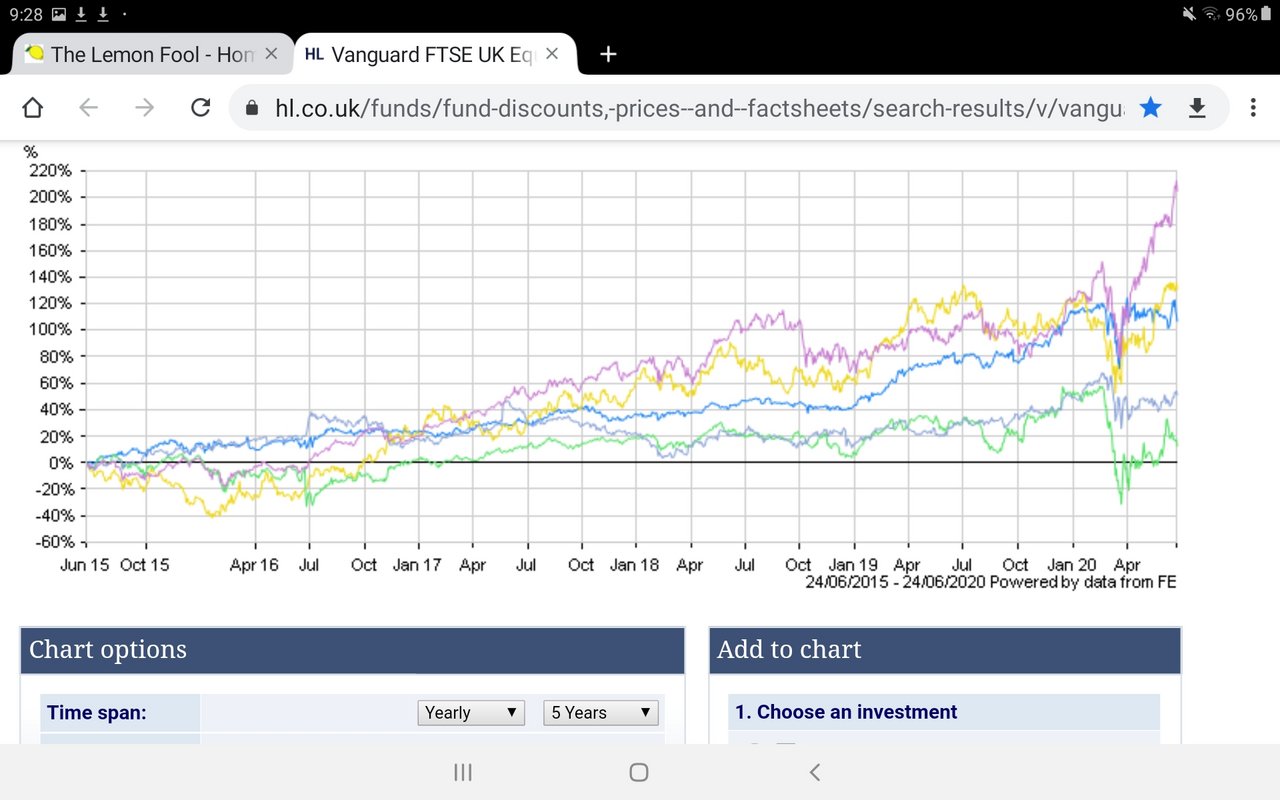

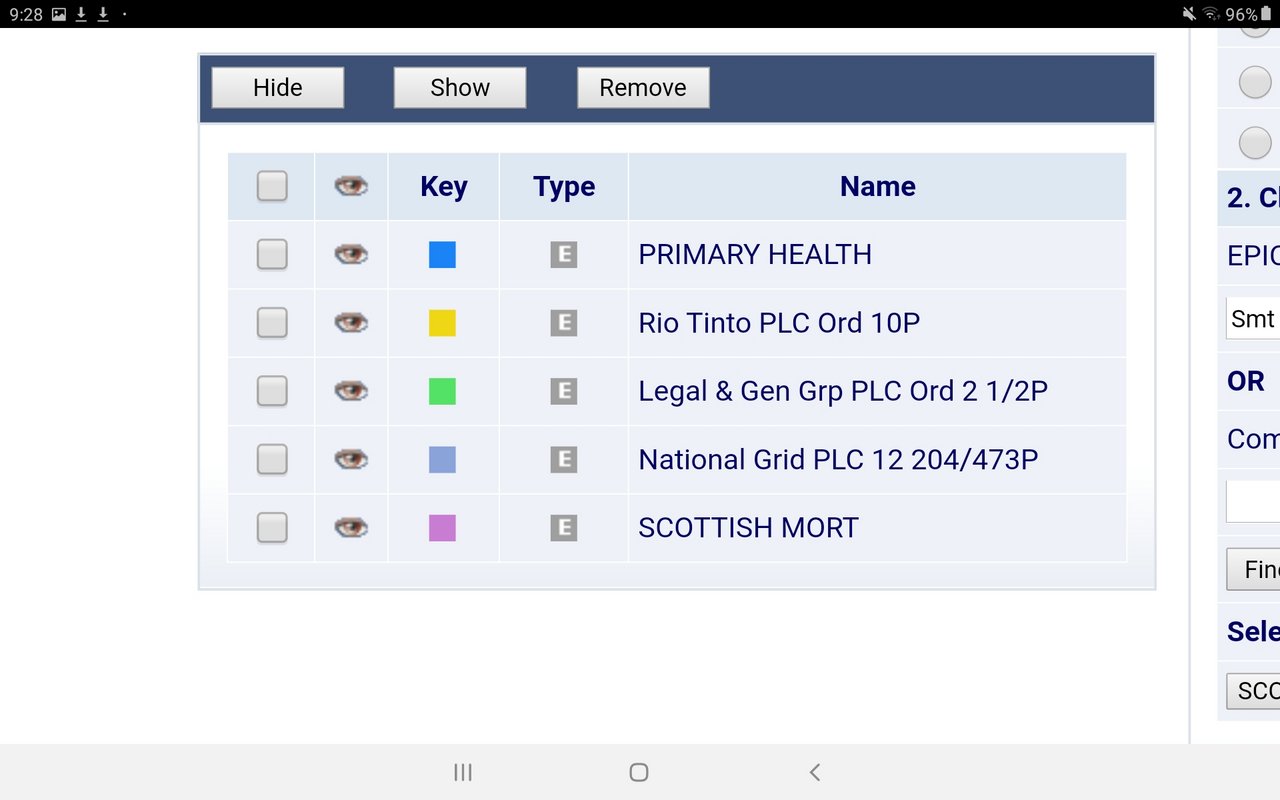

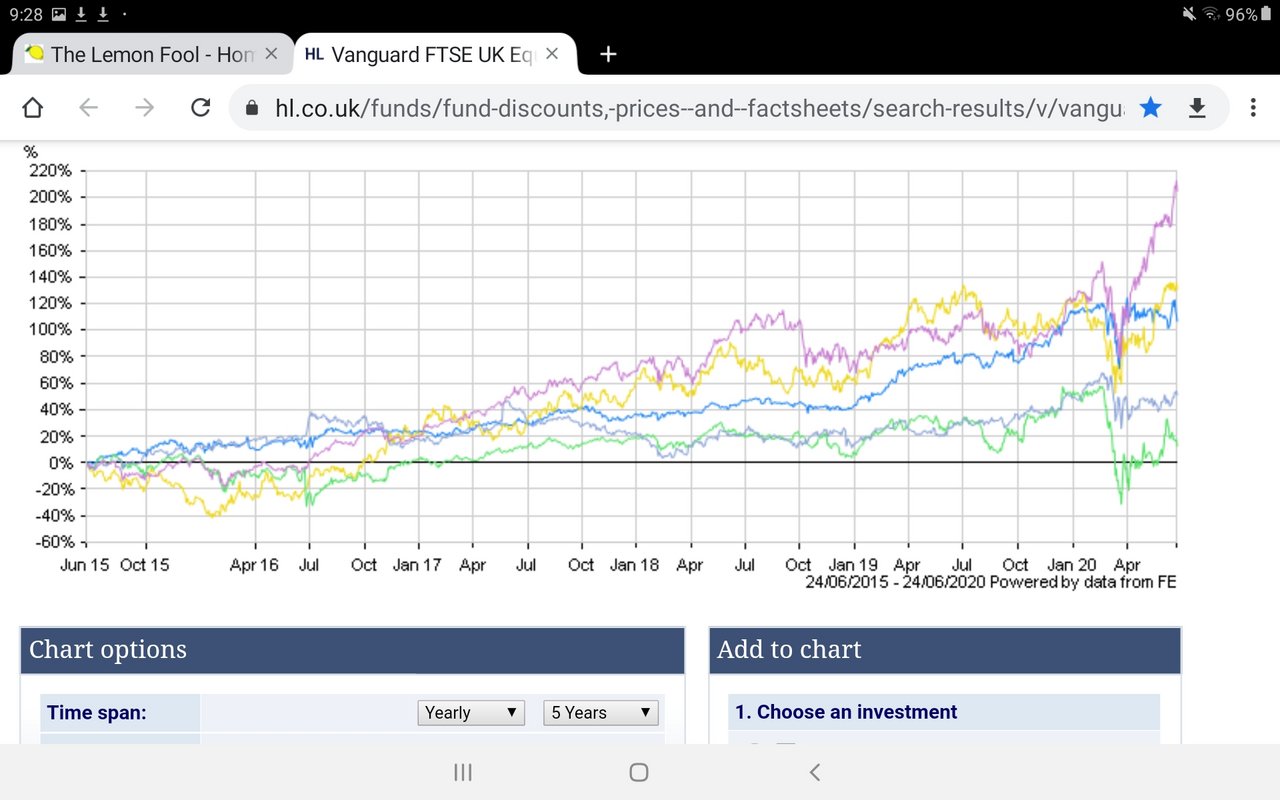

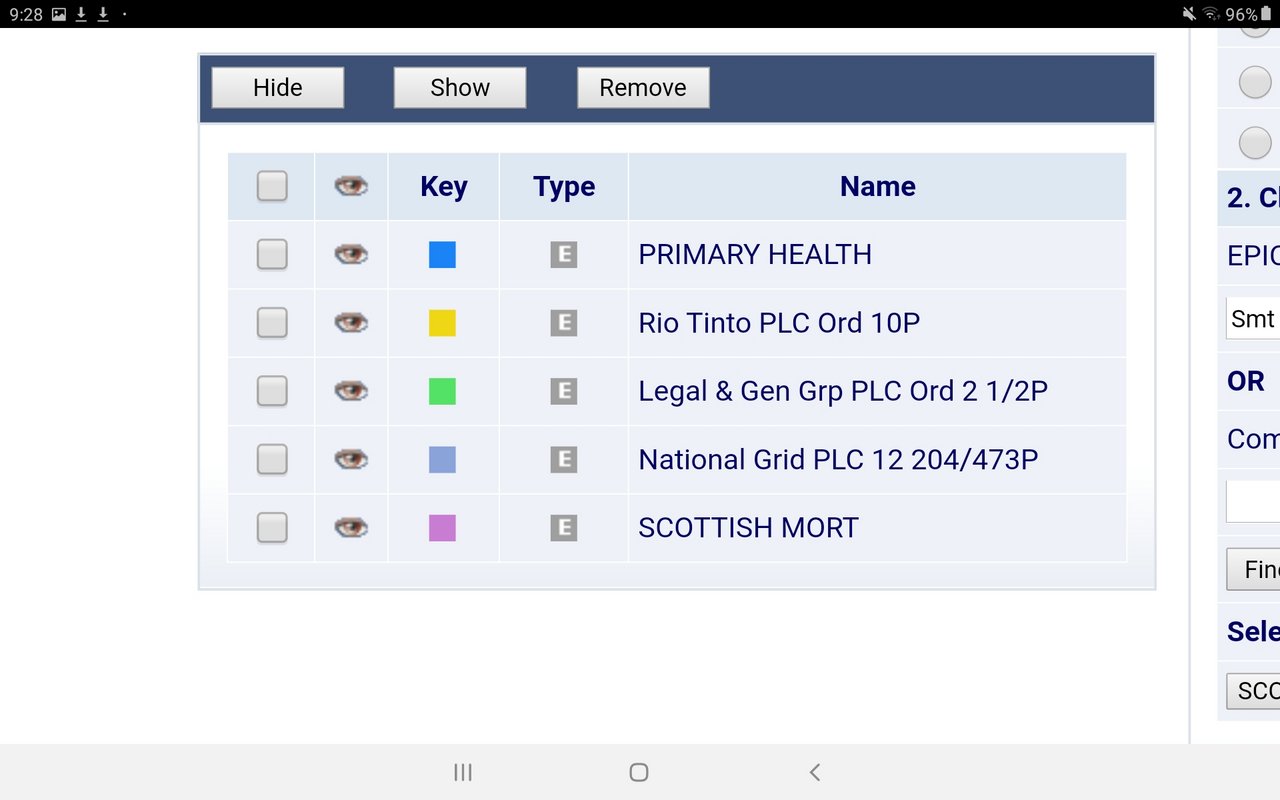

The total return (TR) from PHP (blue curve) over the last 5 years has been impressive knocking the likes of many a HYP share into a cocked hat. Until recently, TR was not far behind SMT ( purple curve) (SMT recent performance is another topic).

( honourable mention to RIO).

Here's another comparison illustrating how far HSBC (shareprice) has fallen despite having shelled out big dividends until the intervention of the PRA....

Noting PHP is now plotted as a yellow curve.

Re: Primary Health Properties (PHP)

Posted: June 25th, 2020, 10:48 am

by Dod101

Thanks monabri. I have held PHP for 5 or 6 years I think. It is currently about 50% over my median (although I prefer to look at the average value and am very comfortable 25% plus or minus around the average) The only problem with PHP is that is it is a REIT with very little other income. It cannot build up substantial reserves and so to expand they have to keep raising money, in their case often by a placing. That can dilute the holding if you are not careful in following these fund raisings.

Dod