Page 1 of 2

Share growth so far this year

Posted: March 1st, 2022, 10:00 am

by tjh290633

I always find it instructive to look at how the shares in my portfolio have done since the start of the year, in terms of share price movement. Here is the result for my shareholdings for the year to last night:

Epic Change Yield

BA. 30.88% 3.49%

RDSB 21.55% 3.32%

S32 19.82% 4.00%

BATS 19.32% 6.68%

RIO 18.38% 14.44%

VOD 17.13% 5.77%

BHP 14.57% 10.19%

TATE 13.88% 4.12%

BP. 10.00% 4.35%

BT.A 9.85% 4.03%

NG. 6.70% 4.37%

PSON 5.68% 3.16%

AZN 4.39% 2.32%

SSE 3.37% 4.82%

CPG 2.60% 0.83%

AV. 2.29% 5.09%

LLOY 1.85% 4.11%

IMB 1.39% 8.49%

MARS 1.23% 0.00%

TSCO -0.05% 3.16%

BLND -0.26% 3.20%

RKT -0.33% 2.76%

UU. -1.33% 4.03%

GSK -3.83% 3.30%

IGG -3.87% 5.53%

ULVR -5.04% 3.90%

ADM -5.70% 8.30%

LGEN -6.82% 6.43%

DGE -7.71% 1.99%

SGRO -9.40% 1.87%

KGF -9.49% 3.04%

SMDS -10.21% 3.74%

PHP -10.57% 4.80%

TW. -14.39% 5.51%

IMI -15.73% 1.62%

MKS -24.46% 0.00%

Av.Chg 2.10% 4.35%

As can be seen, there is little correlation between share price movement and yield. Armament in the form of BAE Systems has just gone to the top, while miners, oils and telecoms lead the way. The leader for last year, MKS with 70% growth, has seen a reversal of fortune to -25%. Last year's laggard, RIO with -10.6% fall, is well up now. This is a common pattern.

TJH

Re: Share growth so far this year

Posted: March 1st, 2022, 6:22 pm

by OhNoNotimAgain

Good effort Terry, but lagging on both measures.

Re: Share growth so far this year

Posted: March 1st, 2022, 7:11 pm

by Lootman

OhNoNotimAgain wrote:Good effort Terry, but lagging on both measures.

Which "measures"? TJH gave numbers; you did not.

That comes across as a rather churlish comment. TJH is one of the most successful investors here. And he keeps impeccable records going back decades so there is no doubt about his numbers.

His YTD performance is flattered by the fact that 6 of his top 9 holdings are in natural resources and defence, which are much in vogue at the moment. Those same holdings will have held him back in recent years but his decision to stick with them is now bearing fruit.

Likewise he has stuck with yield and value even though that has not been the best strategy in recent years, which has been growth. So he is now enjoying a partial reversion to the mean.

Whether being 100% invested in the UK when this topic is "Growth Strategies" might be a better criticism.

Re: Share growth so far this year

Posted: March 1st, 2022, 11:45 pm

by Dod101

Reverting to TJH's post, short termism or what? I really see no point in checking progress over two months. I have some positives and some negatives there, just as I would expect. Overall I am down but am not in the least surprised, given the geopolitical factors in play.

Dod

Re: Share growth so far this year

Posted: March 2nd, 2022, 8:36 am

by Newroad

Hi All.

I always think it's best to be honest (with oneself at least, if no-one else).

An arithmetic mean of units of the three sub-portfolios from 31/12/2021 to 28/02/2022 for me went from £105.91 to £97.75 over the period (I started recording it, twice a month, from £100.00 on 30/06/2021), so around 8.7% down over the period if I have my maths right.

Happy to post a chart if anyone is interested?

Regards, Newroad

Re: Share growth so far this year

Posted: March 2nd, 2022, 9:11 am

by TUK020

I think the "growth strategy" here is more Terry's algorithm for top slicing/top up to use s.p. variability and reversion to the mean to capture gains from the market noise.

The important point he is making: last year's winners are often this year's losers and vice versa.

Re: Share growth so far this year

Posted: March 2nd, 2022, 8:29 pm

by MrFoolish

Dod101 wrote:Reverting to TJH's post, short termism or what? I really see no point in checking progress over two months. I have some positives and some negatives there, just as I would expect. Overall I am down but am not in the least surprised, given the geopolitical factors in play.

Dod

So you did actually check your own

Re: Share growth so far this year

Posted: March 2nd, 2022, 8:34 pm

by Lootman

MrFoolish wrote:Dod101 wrote:Reverting to TJH's post, short termism or what? I really see no point in checking progress over two months. I have some positives and some negatives there, just as I would expect. Overall I am down but am not in the least surprised, given the geopolitical factors in play.

So you did actually check your own

I cannot speak for Dod but in my own case it is not unusual for me to go 2 months or more without checking my portfolio value.

What determines whether I look at it more frequently is the prevailing volatility of the markets. If not much is happening then I probably won't check, because I know the valuation will not have changed much.

But when markets are volatile then the changes can be significant and then I want to know. I typically trade more when markets are down a lot.

Re: Share growth so far this year

Posted: March 2nd, 2022, 9:39 pm

by Dod101

Lootman wrote:MrFoolish wrote:Dod101 wrote:Reverting to TJH's post, short termism or what? I really see no point in checking progress over two months. I have some positives and some negatives there, just as I would expect. Overall I am down but am not in the least surprised, given the geopolitical factors in play.

So you did actually check your own

I cannot speak for Dod but in my own case it is not unusual for me to go 2 months or more without checking my portfolio value.

What determines whether I look at it more frequently is the prevailing volatility of the markets. If not much is happening then I probably won't check, because I know the valuation will not have changed much.

But when markets are volatile then the changes can be significant and then I want to know. I typically trade more when markets are down a lot.

I record the values each week but seldom do anything about them and do not check them very often against previous values. I do though find the historical prices to b3 occasionally worthwhile to know. I suppose therefore that I am hoist on my own petard.

Dod

Re: Share growth so far this year

Posted: March 4th, 2022, 7:48 pm

by Myfyr

Newroad wrote:Hi All.

I always think it's best to be honest (with oneself at least, if no-one else).

An arithmetic mean of units of the three sub-portfolios from 31/12/2021 to 28/02/2022 for me went from £105.91 to £97.75 over the period (I started recording it, twice a month, from £100.00 on 30/06/2021), so around 8.7% down over the period if I have my maths right.

Happy to post a chart if anyone is interested?

Regards, Newroad

My IT ISA (40 ITs) and ETF SIPP (12 ETFs) are both down about 11% (adjusted for dividends where applicable) since 31/12/2021 which was pretty much the peak.

I guess that is about average based on various indices but has put a dent to my FIRE hopes - though i have stress tested a 25% fall and it still looks OK.

I guess there will always be a bogeyman affecting things (Covid, WW3 etc) but makes retirement decisions tricky.

Re: Share growth so far this year

Posted: March 4th, 2022, 7:58 pm

by monabri

Since 11th Feb 2022 which was the peak valuation, the drop in value has been 12.7%. Quite a steep decline...but better than being shelled.

Re: Share growth so far this year

Posted: March 4th, 2022, 8:18 pm

by kempiejon

Myfyr wrote:

My IT ISA (40 ITs) and ETF SIPP (12 ETFs) are both down about 11% (adjusted for dividends where applicable) since 31/12/2021 which was pretty much the peak.

I guess that is about average based on various indices but has put a dent to my FIRE hopes - though i have stress tested a 25% fall and it still looks OK.

I guess there will always be a bogeyman affecting things (Covid, WW3 etc) but makes retirement decisions tricky.

For FIRE I think a greater than 25% fall should be considered. I forget what the worst historic numbers were and how long some of the pain lasted I'm sure a helpful soul will remind me but I think over 50% losses and a number of years to return to historic levels.

Re: Share growth so far this year

Posted: March 4th, 2022, 8:43 pm

by Myfyr

kempiejon wrote:Myfyr wrote:

My IT ISA (40 ITs) and ETF SIPP (12 ETFs) are both down about 11% (adjusted for dividends where applicable) since 31/12/2021 which was pretty much the peak.

I guess that is about average based on various indices but has put a dent to my FIRE hopes - though i have stress tested a 25% fall and it still looks OK.

I guess there will always be a bogeyman affecting things (Covid, WW3 etc) but makes retirement decisions tricky.

For FIRE I think a greater than 25% fall should be considered. I forget what the worst historic numbers were and how long some of the pain lasted I'm sure a helpful soul will remind me but I think over 50% losses and a number of years to return to historic levels.

My 25% drop test (with no recovery for 5 years and RPI only growth / recovery thereafter) is probably nearer 45% given that my ISA is excluded from my FIRE figures. Still unsettling though.

Re: Share growth so far this year

Posted: March 4th, 2022, 8:52 pm

by Myfyr

monabri wrote:Since 11th Feb 2022 which was the peak valuation, the drop in value has been 12.7%. Quite a steep decline...but better than being shelled.

That is so true.

Re: Share growth so far this year

Posted: March 4th, 2022, 9:20 pm

by Newroad

Hi Myfyr.

My portfolios are far simpler than yours (4 holdings for the ISA's and SIPP's, 5 holdings for the JISA's) but the key factor in the slightly lower losses may be the 20-30% holdings in bonds.

Alas the kids smallish (c15%) holdings in MNP in the JISA's - the extra (5th) holdings - have been hammered a bit

Still, I'm not that bothered as I had them almost fully invested in FCIT (the rest was in WTAN) in the big run up from the 2008 GFC, so they've done pretty well all things considered

Regards, Newroad

Re: Share growth so far this year

Posted: March 4th, 2022, 11:22 pm

by tjh290633

I've just updated my data since the original post:

Epic Change Yield

S32 30.65% 3.76%

BA. 25.79% 3.62%

RIO 23.22% 13.65%

BHP 22.57% 9.44%

RDSB 13.01% 3.39%

BATS 12.64% 6.89%

VOD 9.98% 5.93%

BP. 5.34% 4.41%

NG. 4.53% 4.45%

TATE 4.48% 4.30%

AZN 0.01% 2.36%

PSON -1.08% 3.28%

BT.A -1.24% 4.16%

SSE -3.27% 5.24%

UU. -3.31% 4.12%

TSCO -5.02% 3.25%

CPG -5.54% 0.87%

IMB -5.66% 8.76%

AV. -5.75% 5.44%

GSK -7.34% 3.34%

RKT -8.86% 2.88%

LLOY -9.98% 4.43%

MARS -10.45% 0.00%

IGG -11.13% 5.86%

PHP -11.49% 4.82%

DGE -13.06% 2.05%

ULVR -13.56% 4.10%

SGRO -14.13% 1.92%

LGEN -18.08% 6.90%

BLND -20.36% 3.42%

ADM -20.65% 10.98%

KGF -21.05% 3.34%

SMDS -22.69% 4.12%

TW. -24.16% 6.19%

IMI -26.44% 1.72%

MKS -32.02% 0.00%

Av.Chg -4.56% 4.54%

The miners are very much in the ascendance. However the whole has fallen by over 6% over the week.

TJH

Re: Share growth so far this year

Posted: March 5th, 2022, 9:22 am

by Dod101

tjh290633 wrote:The miners are very much in the ascendance. However the whole has fallen by over 6% over the week.

TJH

I have just done my weekly price update. My portfolio is down a mere 4.4% on the week, which is bad enough thank you.

Dod

Re: Share growth so far this year

Posted: March 5th, 2022, 9:53 am

by monabri

monabri wrote:Since 11th Feb 2022 which was the peak valuation, the drop in value has been 12.7%. Quite a steep decline...but better than being shelled.

5.2% drop over the week.

Re: Share growth so far this year

Posted: March 5th, 2022, 10:44 am

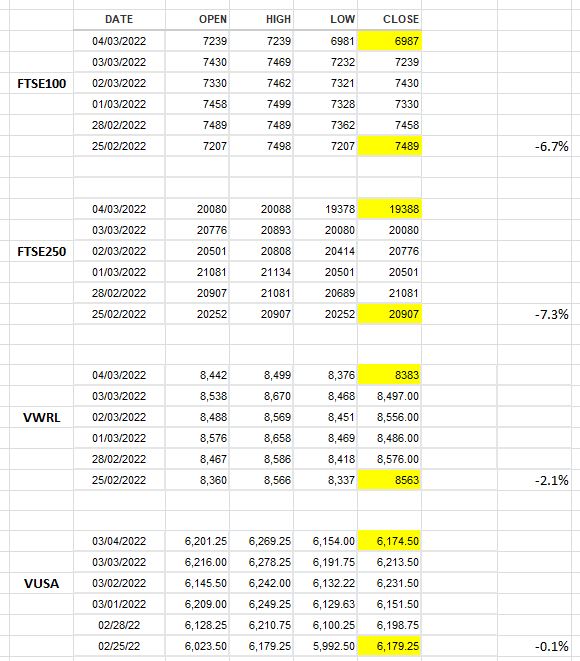

by monabri

Re: Share growth so far this year

Posted: March 5th, 2022, 11:42 am

by BT63

My portfolio has held up well, still within 1% of its all time highs.

I had a good proportion in the right investments but they might have done well for the wrong reasons, so I don't know if I was skilful or lucky.

Essentially last autumn I built up a very large weighting in precious metals and their miners, plus a moderate cash reserve because I was concerned that central banks would struggle with inflation and risk crashing markets and causing a deep recession if they raised rates by more than token gesture amounts.

I was preparing for stagflation and I was expecting things to take a turn for the worse on or before the FOMC March meeting when a rate rise and possible QT was telegraphed as likely, with the taper tantrum of a few years ago giving an idea of what to expect if the Fed tried it again.

But instead of central banks and their actions/inaction causing financial instability and an inflation problem, we have the Ukraine invasion which seems to have caused much the same set of problems.

This week, for the first time in a while FTSE began to take my interest for topping up. P/E 14.5x, yield 2.8%, cover 2.5x. That's not at all expensive, especially considering the very low yields available on bonds or cash.

I'm not yet enthusiastic enough to deploy my cash reserve (8% of portfolio) or switch out of precious metals (36% of portfolio) but I'm now watching closely.