Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Stamp Duty Land Tax

-

Mike4

- Lemon Half

- Posts: 7164

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1651 times

- Been thanked: 3811 times

Stamp Duty Land Tax

Surprisingly little discussion of SDLT here.

Anyway I'm perplexed. I'm buying a pretty little cottage in Wiltshire for £335,000 after selling the big family home in Reading a couple of weeks ago. This house will replace our previous PPR but we still have the BTL portfolio. What does The Team think the SDLT will be?

I've run the figs through the govt website calculator here https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/intro and it gives me £6,750, while applying the rules as I understand them, and as my solicitor tells me, I get £16,800. The 3% surcharge for owning other property surely applies.

I far prefer the lower figure but can't find the exact rules that return it. The govt site seems to ignore the fact I own other houses and therefore appear liable for the extra 3%.

Should I get a different solicitor? Or choose a different SDLT calculator?

Thanks for any advice!

Anyway I'm perplexed. I'm buying a pretty little cottage in Wiltshire for £335,000 after selling the big family home in Reading a couple of weeks ago. This house will replace our previous PPR but we still have the BTL portfolio. What does The Team think the SDLT will be?

I've run the figs through the govt website calculator here https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/intro and it gives me £6,750, while applying the rules as I understand them, and as my solicitor tells me, I get £16,800. The 3% surcharge for owning other property surely applies.

I far prefer the lower figure but can't find the exact rules that return it. The govt site seems to ignore the fact I own other houses and therefore appear liable for the extra 3%.

Should I get a different solicitor? Or choose a different SDLT calculator?

Thanks for any advice!

-

Mike4

- Lemon Half

- Posts: 7164

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1651 times

- Been thanked: 3811 times

Re: Stamp Duty Land Tax

richlist wrote:Your SDLT will be £16800.

Yes I'm inclined to this view too, but I'm trying to understand why the Govt SDLT calculator, which one would expect to be authoritative, says SDLT for this transaction will be £6,750.

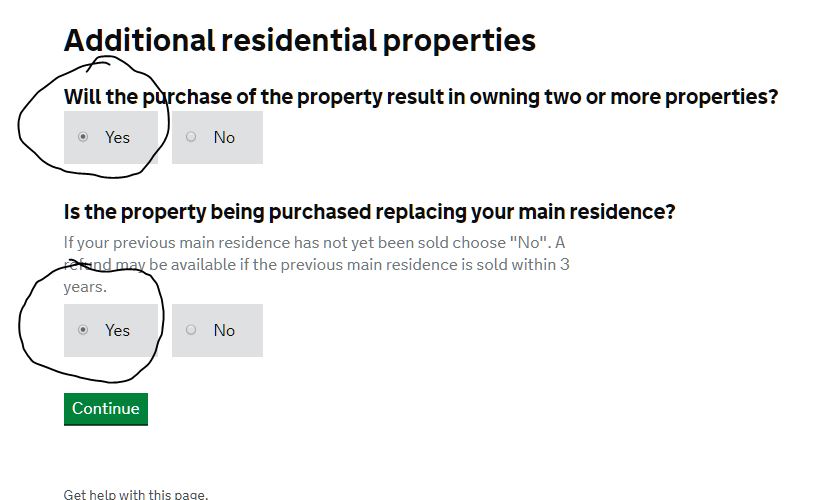

Here are the questions it asks and the answers I'm putting into the govt calculator when it gives me £6,750. Try it for yourself! It seems to be that question "Are you replacing a main residence" (which we are) that causes the result of £6,750 instead of £16,800. But why does it do this? And more pertinently, is it right?

Freehold or leasehold? Freehold

Residential or non-residential? Residential

Effective date of transaction? 1 December 2019

Are you purchasing the property as an individual? Yes

Additional residential property? Yes

Will you own two or more properties? Yes

Are you replacing a main residence? Yes

Purchase price? £335,000

SDLT £6,750

-

richlist

- Lemon Quarter

- Posts: 1589

- Joined: November 4th, 2016, 3:54 pm

- Has thanked: 33 times

- Been thanked: 477 times

Re: Stamp Duty Land Tax

I take the view that virtually anything that is handled by central Government will be wrong, requires careful scrutiny and cannot be relied on. My wife on the other hand takes the opposite view and doesn't understand how it's even possible for the Gov to make a mistake.

If you already have a property.....e.g. holiday home in UK or abroad, investment property, a spare castle in Scotland etc.....then you do have to pay a 3% surcharge. Them is the rules.

I think the issue you have is around your understanding of the phrase ' replacing an existing property'...... you have already sold/completed the sale of your previous property, presumably currently living in temporary accommodation pending the purchase/ completion of another property. In your mind it's a replacement but it's a straightforward purchase without any of the normal rules that would apply to people who buy another property without having sold their previous property.

If you already have a property.....e.g. holiday home in UK or abroad, investment property, a spare castle in Scotland etc.....then you do have to pay a 3% surcharge. Them is the rules.

I think the issue you have is around your understanding of the phrase ' replacing an existing property'...... you have already sold/completed the sale of your previous property, presumably currently living in temporary accommodation pending the purchase/ completion of another property. In your mind it's a replacement but it's a straightforward purchase without any of the normal rules that would apply to people who buy another property without having sold their previous property.

-

EmptyGlass

- Posts: 37

- Joined: November 10th, 2016, 7:27 pm

- Has thanked: 5 times

- Been thanked: 19 times

Re: Stamp Duty Land Tax

Looking at https://www.gov.uk/guidance/stamp-duty- ... l-property

"You must pay the higher SDLT rates when you buy a residential property (or a part of one) for £40,000 or more, if all the following apply:

it will not be the only residential property worth £40,000 or more that you own (or part own) anywhere in the world

you have not sold or given away your previous main home

no one else has a lease on it which has more than 21 years left to run"

In your case you fail the 2nd point so you don't pay higher SDLT ?

Good luck.

"You must pay the higher SDLT rates when you buy a residential property (or a part of one) for £40,000 or more, if all the following apply:

it will not be the only residential property worth £40,000 or more that you own (or part own) anywhere in the world

you have not sold or given away your previous main home

no one else has a lease on it which has more than 21 years left to run"

In your case you fail the 2nd point so you don't pay higher SDLT ?

Good luck.

-

Mike4

- Lemon Half

- Posts: 7164

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1651 times

- Been thanked: 3811 times

Re: Stamp Duty Land Tax

EmptyGlass wrote:Looking at https://www.gov.uk/guidance/stamp-duty- ... l-property

"You must pay the higher SDLT rates when you buy a residential property (or a part of one) for £40,000 or more, if all the following apply:

it will not be the only residential property worth £40,000 or more that you own (or part own) anywhere in the world

you have not sold or given away your previous main home

no one else has a lease on it which has more than 21 years left to run"

In your case you fail the 2nd point so you don't pay higher SDLT ?

Good luck.

This is true, so by Jove I think you've cracked it! Looks like it will be £6,750 after all. How can I thank you enough? Have a Big Fat rec (to use old TMF terminology)!!

Will update this thread as and when I get our professional advisors to agree you are right and the lower figure is correct

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: Stamp Duty Land Tax

Mike4 wrote:Surprisingly little discussion of SDLT here.

Anyway I'm perplexed. I'm buying a pretty little cottage in Wiltshire for £335,000 after selling the big family home in Reading a couple of weeks ago. This house will replace our previous PPR but we still have the BTL portfolio. What does The Team think the SDLT will be?

I've run the figs through the govt website calculator here https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/intro and it gives me £6,750, while applying the rules as I understand them, and as my solicitor tells me, I get £16,800. The 3% surcharge for owning other property surely applies.

I far prefer the lower figure but can't find the exact rules that return it. The govt site seems to ignore the fact I own other houses and therefore appear liable for the extra 3%.

Should I get a different solicitor? Or choose a different SDLT calculator?

Thanks for any advice!

I know nothing of this but a) does the owning of BTL properties affect your situation? They are a business after all and just because you let properties rather than sell bananas at a market stall should not make any difference surely?

Secondly, why would you change solicitor in order to find one that agrees with you that you should be paying more SDLT? How would you choose one anyway?

Dod

-

richlist

- Lemon Quarter

- Posts: 1589

- Joined: November 4th, 2016, 3:54 pm

- Has thanked: 33 times

- Been thanked: 477 times

Re: Stamp Duty Land Tax

I agree with your solicitor, I still think your SDLT bill will be £16800 as you already own property......

-

scrumpyjack

- Lemon Quarter

- Posts: 4843

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 613 times

- Been thanked: 2698 times

Re: Stamp Duty Land Tax

Isn't the point that you get one house at the lower SDLT rate and any further houses are at the higher rate?

Your main residence is the lower rate SDLT house and as you sold it, the replacement main residence is at the lower rate?

Your main residence is the lower rate SDLT house and as you sold it, the replacement main residence is at the lower rate?

-

Gersemi

- Lemon Slice

- Posts: 497

- Joined: November 4th, 2016, 3:57 pm

- Has thanked: 535 times

- Been thanked: 224 times

Re: Stamp Duty Land Tax

I would also look at SDLTM09765 https://www.gov.uk/hmrc-internal-manual ... sdltm09765 , these are the conditions in S128 FA 2016 which introduced the legislation. This confirms that the higher charge does not apply if the property replaces your main residence (but you must have already disposed of the previous main residence, you can reclaim the additional rate if there is a short overlap).

-

richlist

- Lemon Quarter

- Posts: 1589

- Joined: November 4th, 2016, 3:54 pm

- Has thanked: 33 times

- Been thanked: 477 times

Re: Stamp Duty Land Tax

But the OP already owns property that has not been disposed of. Therefore the 3% surcharge applies.

I guess you can send hmrc £6750 and they will just ask for the rest.

I guess you can send hmrc £6750 and they will just ask for the rest.

-

Lootman

- The full Lemon

- Posts: 18871

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 635 times

- Been thanked: 6645 times

Re: Stamp Duty Land Tax

Dod101 wrote: does the owning of BTL properties affect your situation? They are a business after all and just because you let properties rather than sell bananas at a market stall should not make any difference surely?

I somehow doubt that such an argument would be accepted by HMRC no matter how reasonable it seems to you and I. But I do wonder whether the BTLs count as other properties that you own if and only if they are held under a corporation rather than as an individual? That would imply that your name does not show up on the title as the legal and beneficial owner. Rather the registered owner is an entity and not a person.

scrumpyjack wrote:Isn't the point that you get one house at the lower SDLT rate and any further houses are at the higher rate? Your main residence is the lower rate SDLT house and as you sold it, the replacement main residence is at the lower rate?

That is how I would look at it as well. The over-riding factor is that both the property being sold and the new one being purchased are PPRs, and so it is a genuine replacement and the lower rate applies.

-

Clitheroekid

- Lemon Quarter

- Posts: 2867

- Joined: November 6th, 2016, 9:58 pm

- Has thanked: 1389 times

- Been thanked: 3797 times

Re: Stamp Duty Land Tax

Mike4 wrote:Are you replacing a main residence? Yes

That's your answer. You don't pay the additional rate when it's your main residence if you've already sold your existing main residence.

If you hadn't yet sold it you would have to pay the additional rate, but you could then claim a refund when it was later sold (provided it was within three years).

-

Mike4

- Lemon Half

- Posts: 7164

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1651 times

- Been thanked: 3811 times

Re: Stamp Duty Land Tax

Clitheroekid wrote:Mike4 wrote:Are you replacing a main residence? Yes

That's your answer. You don't pay the additional rate when it's your main residence if you've already sold your existing main residence.

If you hadn't yet sold it you would have to pay the additional rate, but you could then claim a refund when it was later sold (provided it was within three years).

Thanks CK. However there is more to it than this. Sorry to be drip-feeding info which I now think I should have mentioned in the first place.

In reality my wife and I live in separate houses. She has a house we/she originally bought as a BTL (in her name only), then we paid off the BTL mortgage and she moved in to live there, and I stayed living in the original family home recently sold. This happened some years ago. We are not formally separated, our relationship has not 'broken down' and we intend to remain married. Does this make a difference to your view (or to anybody else's)?

Reading the HMRC guidance pasted below, I think condition D is not met and therefore the 3% extra SDLT is not payable. But should I buy the new house as a sole proprietor or as a joint purchase with my wife? Would one way or the other scupper us or doesn't it matter?

Many thanks....

Individuals – purchase of a single dwelling – Condition D

3.16 Condition D is that the purchased dwelling is not a replacement of the

purchaser’s only or main residence19

.

3.17 There are two parts to a replacement of a purchaser’s main residence:

there must be a disposal of the purchaser’s or their spouse or civil partner’s

previous main residence20, and

the dwelling acquired must be intended to be occupied as the individual’s

only or main residence21

.

3.18 The disposal of the previous main residence does not have to be by way of sale,

although that is likely to be the case for most individuals.

3.19 There are two situations in which a purchase of a dwelling will be a replacement

of a main residence. The first is where the disposal occurred before, or on the

day of the purchase22. The second is where the purchase happens first and then

the disposal happens later23

.

3.20 There is a replacement of a main residence if, in the three years ending with the

purchase, the purchaser disposed of a major interest in another dwelling24 and

that other dwelling was, at some time in the three year period, the only or main

residence of the purchaser25

.

3.21 There is also a replacement of a main residence if in the three years ending with

the purchase, the purchaser’s spouse or civil partner disposed of a major interest

in another dwelling and that other dwelling was, at some time in the three year

period, the only or main residence of the purchaser.

As an aside which may not be relevant, I see HMRC regard married couples as still 'living together' for CGT purposes if the relationship has not 'broken down', which ours hasn't.

"What counts as ‘living together’

You and your spouse or civil partner are treated as living together unless you’re separated:

under a court order

by a formal Deed of Separation executed under seal (in Scotland a deed should be witnessed)

in such circumstances that the separation is likely to be permanent

In each case the marriage or civil partnership must have broken down. If the marriage or civil partnership has not broken down but the two of you do not live in the same house, you are still treated as living together for Capital Gains Tax purposes."

https://www.gov.uk/government/publicati ... g-together

-

scrumpyjack

- Lemon Quarter

- Posts: 4843

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 613 times

- Been thanked: 2698 times

Re: Stamp Duty Land Tax

In spite of these complications, you sold your main residence and so as far as I can see you are entitled to treat the house you are acquiring as your main residence, and it will indeed be so, so you qualify for the lower rate of stamp duty.

It might be another question for debate if your wife sold the buy to let she currently occupies and tried to claim CGT PRR for her period of occupation!

It might be another question for debate if your wife sold the buy to let she currently occupies and tried to claim CGT PRR for her period of occupation!

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Stamp Duty Land Tax

Hi Mike

Long time no speak!

Following on from Gersemi’s helpful link, have you studied this page in the HMRC Manual?:

SDLT - higher rates for additional dwellings: Meaning of 'main residence'

https://www.gov.uk/hmrc-internal-manuals/stamp-duty-land-tax-manual/sdltm09812

Not having read the entire Topic but did your (soon to be ex?) Solicitor go into any detail as to why the higher rate would be payable (assuming you gave them as much information as we now have).

PD

Long time no speak!

Following on from Gersemi’s helpful link, have you studied this page in the HMRC Manual?:

SDLT - higher rates for additional dwellings: Meaning of 'main residence'

https://www.gov.uk/hmrc-internal-manuals/stamp-duty-land-tax-manual/sdltm09812

Not having read the entire Topic but did your (soon to be ex?) Solicitor go into any detail as to why the higher rate would be payable (assuming you gave them as much information as we now have).

PD

-

monabri

- Lemon Half

- Posts: 8414

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Stamp Duty Land Tax

monabri wrote:I ran the numbers through the .Government calculator and I came up with the lower value (£6.7k) ...

Yes the mathematical calculation of £6,750 isn’t in doubt, as per the OP’s OP!

The Topic has since moved on to the definition of Main Residence for SDLT purposes, as outlined in the OP’s follow up post 3 days ago:

viewtopic.php?p=252431#p252431

-

PinkDalek

- Lemon Half

- Posts: 6139

- Joined: November 4th, 2016, 1:12 pm

- Has thanked: 1589 times

- Been thanked: 1801 times

Re: Stamp Duty Land Tax

Mike4 wrote:[Will update this thread as and when I get our professional advisors to agree you are right and the lower figure is correct

This thread has been referenced today.

What happened in your case (or did you pull out

-

Mike4

- Lemon Half

- Posts: 7164

- Joined: November 24th, 2016, 3:29 am

- Has thanked: 1651 times

- Been thanked: 3811 times

Re: Stamp Duty Land Tax

PinkDalek wrote:Mike4 wrote:[Will update this thread as and when I get our professional advisors to agree you are right and the lower figure is correct

This thread has been referenced today.

What happened in your case (or did you pull out)?

We completed the purchase and our solicitor accepted our argument that we should pay the lower rate of tax. They also pointed out that if the IR decided to mount an investigation and found against us, we would have to pay the higher rate. Nearly a year has passed with no investigation.

Who is online

Users browsing this forum: No registered users and 18 guests